Which is the Best Health Insurance for Pre-Existing Conditions in the UAE?

Table of Contents

ToggleLiving in the UAE with a long-term health condition brings a quiet worry that never fully switches off. You plan your work, your family life, even your visa renewals, yet one question keeps coming back. Will my insurance actually cover me when I need it most? That uncertainty is exactly why finding the best health insurance for pre-existing conditions in the UAE in 2026 matters more than ever. One wrong decision can result in delays, denied claims, or unexpected out-of-pocket costs.

This guide cuts through that stress. Step by step, it explains how Health Insurance in Dubai UAE works in the UAE when you already have a medical history, what has changed in 2026, and which options genuinely protect you. From government-backed schemes to employer and individual plans, you will learn what applies to your situation, what to avoid, and how to move forward with confidence. Stay with us, this clarity can save you money, time, and peace of mind.

What Qualifies as a Pre-Existing Condition in the UAE?

Before you compare plans or prices, you need clarity on one thing. Does your condition count as pre-existing under UAE health insurance rules? In 2026, the answer depends on facts, not assumptions.

Legal Definition

Under UAE health insurance regulations, a pre-existing condition means any medical issue that existed before your policy’s start date. Insurers look beyond formal diagnoses and assess real medical history. This includes conditions that were:

- Diagnosed by a doctor.

- Treated or monitored in the past.

- Showing symptoms, even without a formal diagnosis.

- Managed through medication or lifestyle changes.

If it existed before your coverage began, insurers treat it as pre-existing. This rule applies consistently across most plans when assessing the best health insurance for pre-existing conditions UAE 2026.

Common Examples Seen in the UAE

To help you identify your situation quickly, these conditions usually fall under pre-existing cover review:

- Diabetes and hypertension, even if well controlled.

- Heart disease, asthma, or chronic respiratory issues.

- Past surgeries or injuries that still need follow-ups.

- Ongoing cancer treatment, chemotherapy, or dialysis.

- Mental health conditions requiring therapy or medication.

- Long-term medication use for any condition.

- Health insurers now also classify long-term COVID-related complications as pre-existing conditions if symptoms continue beyond recovery and require medical care.

Quick tip: If you take regular medication or visit a specialist, disclose it upfront. Because transparency protects your claims later.

Now that you know where you stand, the next section breaks down which insurance options actually cover these conditions and how they compare in real life.

Health Insurance Options Ranked by Pre-Existing Condition Coverage

Once you know your condition qualifies as pre-existing, the next step is choosing a plan that actually supports it. Not all policies handle medical history the same way, and in 2026, these three options stand out clearly when ranking the best health insurance for pre-existing conditions UAE 2026.

1: Basic Health Insurance Scheme

Best for most employed UAE residents

This option sits at the top because it solves the biggest concern first: access. It offers coverage without delays and keeps costs predictable, which is exactly why many employees rely on it.

Quick Comparison

- Waiting period: None for chronic and pre-existing conditions.

- Cost: Approximately AED 320 per year, paid by the employer.

- Who is eligible: Private sector employees and domestic workers.

- What is covered: Emergency care, inpatient and outpatient treatment, medication, and chronic disease management.

Why it Ranks First

- No waiting period means treatment starts immediately.

- Lowest fixed cost, regardless of medical history.

- Mandatory for eligible employees, so coverage stays consistent.

- Direct access to approved hospitals and clinics.

Actionable tip: If you are employed, confirm your employer has activated this policy before visa renewal.

2: Group Employer Health Insurance

Best for companies and salaried professionals.

Group Medical Insurance for your employees work differently because insurers assess the group, not just the individual. This often results in faster access to care for employees with existing conditions.

Underwriting Types

- Medical History Disregarded: Pre-existing conditions covered from day one.

- Moratorium-based coverage: Conditions covered after a symptom-free period.

Coverage Overview

Underwriting type: Medical History Disregarded

- Pre-existing coverage: Immediate

Underwriting type: Moratorium

- Pre-existing coverage: After the waiting period ends

Actionable tip: Ask HR which underwriting method your company policy follows before relying on coverage.

3: Individual Health Insurance Plans

Best for freelancers, self-employed individuals, and investors

Best Individual Medical Insurance Company in Dubai UAE offer flexibility but demand careful review. Insurers assess your full medical history before confirming coverage.

What to Expect

- Full medical underwriting at the application stage.

- Waiting periods range from 6 to 12 months, sometimes longer.

- Condition-specific exclusions or optional riders.

Simple Comparison

- Underwriting: Full medical review.

- Waiting period: Typically 6–12 months.

- Coverage control: Depends on disclosures and approved riders.

Actionable tip: Disclose everything upfront to avoid claim issues later.

Now that you understand how each option ranks, the next section explains waiting periods in detail and shows what is covered and what is not during that time.

The 2026 Basic Health Insurance Scheme Explained

The Basic Health Insurance Scheme reshaped healthcare access in the UAE by making coverage mandatory from 2025 onward for eligible employees. What truly sets it apart in 2026 is its zero waiting period for pre-existing and chronic conditions. That single change removed one of the biggest barriers people faced when they needed care immediately but had a medical history.

Key Benefits You Can Rely On

This scheme focuses on practical, everyday healthcare needs rather than limited, short-term fixes. It includes:

- Chronic disease management, such as diabetes and hypertension care.

- Emergency treatment, including hospitalisation when it matters most.

- Inpatient and outpatient services through approved providers.

- Essential medications are prescribed as part of ongoing treatment.

These benefits work together to ensure continuity of care, not just one-time coverage.

Eligibility Criteria Explained Simply

The scheme applies to private sector employees and domestic workers in the UAE. Coverage connects directly to your residency permit, meaning insurance must remain active for visa issuance or renewal so do always keep check on your insurance status. Individuals without an employer sponsor must explore other insurance routes.

Problem solved: If you are employed and managing a pre-existing condition, this scheme answers the key question clearly. It provides immediate coverage without delays, exclusions, or medical uncertainty.

Now, to make informed decisions and avoid treatment surprises, it is important to understand how waiting periods actually work in 2026 and when coverage truly begins.

What Is a Waiting Period?

A waiting period is the time between the start of your health insurance policy and the point when your pre-existing condition becomes eligible for full coverage. During this phase, insurers limit routine or planned treatment related to existing conditions. The rule exists to prevent misuse, but in practice, it mainly affects when you can access non-urgent care.

To keep this clear, emergency care follows a different rule.

Coverage During the Waiting Period

Scenario | Covered During Waiting Period? |

Medical emergencies linked to a pre-existing condition | Yes |

Sudden hospitalisation due to complications | Yes |

Routine check-ups or follow-up visits | No |

Regular medication refills | No |

Specialist consultations for existing conditions | No |

Practical takeaway: If your condition worsens suddenly, treatment continues. Planned care must wait until the waiting period ends.

Understanding waiting periods helps you plan treatment timelines. In the next section, we will walk through a clear action plan to help you secure coverage without unnecessary delays.

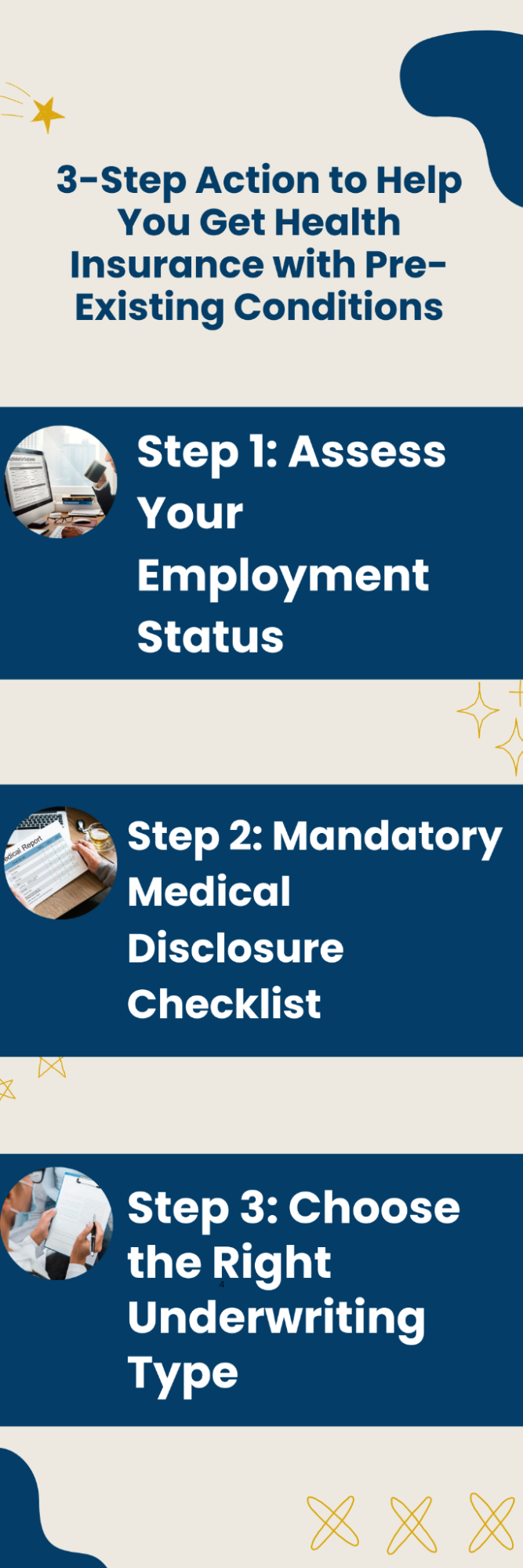

3-Step Action to Help You Get Health Insurance with Pre-Existing Conditions

Once you understand your options and waiting periods, the next move is action. This step-by-step plan helps you secure the best health insurance for pre-existing conditions UAE 2026 without confusion or costly mistakes.

Step 1: Assess Your Employment Status

Your work status shapes which insurance path fits you best, so start here.

- Employed: Rely on the Basic Health Insurance Scheme or a group employer policy. These options usually offer faster access and fewer restrictions on pre-existing conditions.

- Self-employed or freelancer: Choose an individual health insurance plan and prepare for medical underwriting and possible waiting periods.

- Student: Use the university-approved policy and consider a top-up plan if you need wider coverage.

Quick tip: Match your insurance type to your visa category before comparing benefits.

Step 2: Mandatory Medical Disclosure Checklist

Honest disclosure keeps your claims secure and avoids disputes later.

Make sure you list:

- All existing medical conditions, even if controlled.

- Current medications and dosages.

- Past treatments or surgeries.

- Any hospitalisation history.

Why this matters: Insurers approve claims based on what you declare. Clear information protects your coverage when you need it most.

Step 3: Choose the Right Underwriting Type

Different situations require different underwriting approaches.

Employed under company policy | Medical History Disregarded |

Switching insurers below age limits | Continuity or moratorium-based |

High-risk or multiple conditions | Full medical underwriting |

Actionable insight: Always ask which underwriting method applies before signing the policy.

With these steps in place, the next section explains how Insura can help you.

Why Insura Is the Most Trusted Health Insurance Partner in the UAE

Choosing health insurance for a pre-existing condition is not just about policies on paper. It is about who stands with you when rules feel unclear and timelines feel tight. This is where Insura.ae Most trusted Insurance Company comes in.

Built on Local Expertise

Insura works inside the UAE system every day. The team understands DHA regulations, visa-linked insurance rules, and how insurers actually assess pre-existing conditions in 2026. This local insight helps customers avoid plans that look good upfront but fail during claims.

Honest Guidance

Insura does not push one-size-fits-all plans. Instead, it helps you match your employment status, medical history, and budget with the right option.

- Clear explanation of waiting periods and exclusions.

- Transparent comparison between basic, group, and individual plans.

- No hidden surprises after policy purchase.

Practical tip: Always ask for a plan breakdown in writing. Insura provides this before you commit.

Strong Insurer Network Across the UAE

With access to 100+ insurance companies, Insura compares coverage that many individuals cannot access on their own. This matters when negotiating pre-existing condition coverage, premium loading, or rider options.

Support That Extends Beyond Purchase

Insurance does not end after payment. Insura supports customers during claims, renewals, and policy changes, especially when medical conditions evolve over time.

This approach makes Insura a reliable guide, not just a broker. Next, let us look at the cost impact of pre-existing conditions in 2026 and how to plan your budget wisely without overpaying.

Conclusion

In 2026, living with a pre-existing condition in the UAE no longer means settling for limited care or uncertain coverage. Clear regulations, structured insurance schemes, and better underwriting practices have opened doors that were once difficult to access. What matters now is understanding how these options work and choosing the one that fits your life, not just your visa.

For employed residents, the Basic Health Insurance Scheme offers immediate and dependable coverage. Salaried professionals often benefit from group employer policies with fewer restrictions. Freelancers, investors, and students can still secure protection through individual plans, provided they plan for waiting periods and disclose medical history correctly. Each path works when chosen with clarity.

Informed decisions reduce unexpected costs, delayed treatment, and claim disputes. When you understand the rules, insurance becomes a safeguard rather than a risk. If you want steady guidance through this process, Insura remains a dependable partner, helping you navigate choices with confidence, accuracy, and care.

Frequently Asked Questions

Do any insurers cover pre-existing conditions?

Yes. In the UAE, insurers are required to offer health insurance even if you have a pre-existing condition. Coverage terms depend on the policy type and may include immediate cover, waiting periods, or condition-specific limits.

Does health insurance in Dubai cover pre-existing conditions?

Yes, Dubai health insurance covers pre-existing conditions under regulated frameworks. Employer-provided plans and the Basic Health Insurance Scheme often provide faster or immediate access, while individual plans may apply waiting periods.

Top 5 health insurance companies in the UAE

Some widely recognised providers in the UAE include Daman, ADNIC, Orient Insurance, AXA Gulf, and MetLife UAE. Coverage for pre-existing conditions varies by plan and underwriting.

What pre-existing conditions are not covered?

Conditions may remain excluded if they are not disclosed, fall under permanent exclusions, or relate to elective or cosmetic treatment. Some individual policies also exclude specific high-risk conditions unless added through a rider.

Which insurance company covers pre-existing diseases?

Coverage depends more on the policy structure than the insurer alone. Through a broker like Insura, residents can compare multiple insurers and find plans that offer coverage for pre-existing diseases under UAE regulations.