Health Insurance

Health Insurance in UAE to save your medical expenses in. We are providing quotes from top insurance companies. Avail the offers & benefits of our health insurance services. Get your peace of mind now.

Health Insurance in UAE: Your Medical Expense Savior!

Never Underestimate Importance of Health Insurance in UAE, it as an safety assurance of Your Present & Future Medical Expense!

Early to Bed, Early to Rise, Early to have an Health Insurance Makes you Healthy, Wealthy & Wise!

Just like sleep recharges your body, getting Health Insurance in Dubai & UAE safeguards your future like your essential safety net in life.

Types of Health Insurance

Individual Health Insuarnce

Personalized coverage for a single person, even if employer-provided insurance is available.

Family Health Insurance

Comprehensive coverage for the entire family, simplifying healthcare management under a single policy.

Senior Citizen Health Insurance

Tailored for elderly individuals, addressing age-related health concerns and chronic conditions.

Group Health Insurance

Covers employees within a company, offering standard features with some customization options.

Critical Illness Health Insurance

Coverage for specific life-threatening illnesses, offering a lump sum payment upon diagnosis.

Why should you have Health Insurance in UAE?

1. Mandatory in Dubai & UAE:

Health insurance isn’t just a choice in Dubai & UAE; it’s a legal requirement. Protect your health and your wallet by staying compliant with the law.

2. Changing Life:

Life can change in an instant. Taking Health Insurance in Dubai & UAE ensures you’re prepared for the sudden turn life takes.

3. Rising Medical Costs:

Medical expenses are rising fast. Health insurance acts as your financial shield, protecting you from the burden of costly treatments and hospital visits.

4. Tax Benefits:

Health insurance doesn’t just protect your health—it boosts your savings with tax benefits.

5. Better Financial Planning:

Good financial planning includes health insurance. It’s the cornerstone of a secure future, helping you manage risks and safeguard your finances.

What Type of Health Insurance Plan You Should Buy in UAE?

- Individual Health Insurance: Get personalized coverage that’s perfectly tailored to protect you when you need it most.

- Family Health Insurance: Secure comprehensive health coverage for your entire family under one umbrella.

- Senior Citizen Health Insurance: Ensure a stress-free retirement with health insurance designed for seniors’ unique needs.

- Group Health Insurance: Group health insurance keeps your workforce healthy, happy, and productive.

- Critical Illness Health Insurance: Get coverage that stands by you during critical health crises.

Secure Your Finances with Affordable Health Insurance in UAE

Your health is your greatest treasure, and at Insura.ae, we treat it that way. Our health insurance plans offer comprehensive protection at competitive prices, ensuring high value for your investment. With 24/7 support from our expert team, you can focus on enjoying things you love with your loved ones, knowing you’re fully covered. Trust Insura.ae to find the best health insurance tailored just for you.

Key Features of iNSURA's Powered by Pioneer Health Insuarnce:

| Key Features | Insurance Benefits |

|---|---|

| Health Insurance Price | Starting at Just @ 4 AED / Per Day |

| Coverage Amount | 1 Million AED |

| Minimum Health Insurance Entry Age | 0 Yrs |

| Maximum Health Insurance Entry Age | 99 Yrs |

| Process to Apply | Visit Insura.ae fill the form then our Health Insurance Manager Directly Contact You. |

| Health Insurance Claim Procedure | Cashless / Reimbursement |

| Health Insurance is important for | Self, Family, Worker or Domestic Worker, Investor |

| Health Insurance Covered | In-Patient Service, Out-Patient Service, Maternity Coverage, Dental Cover |

| Purchase / Renew Process | Online |

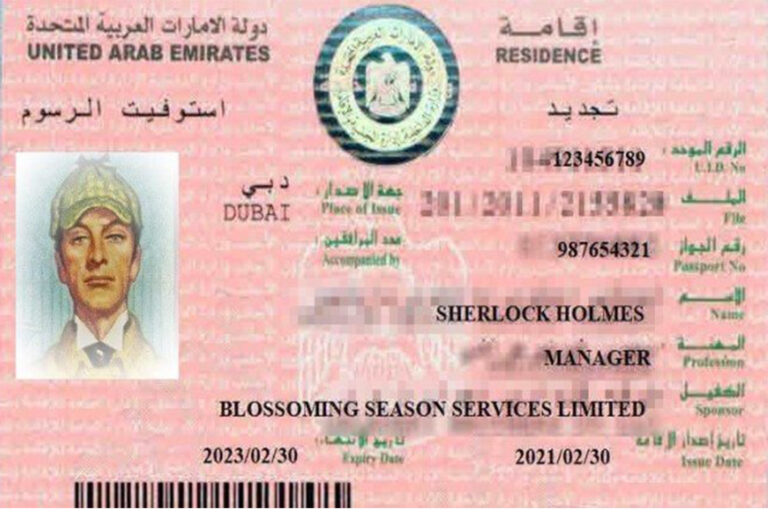

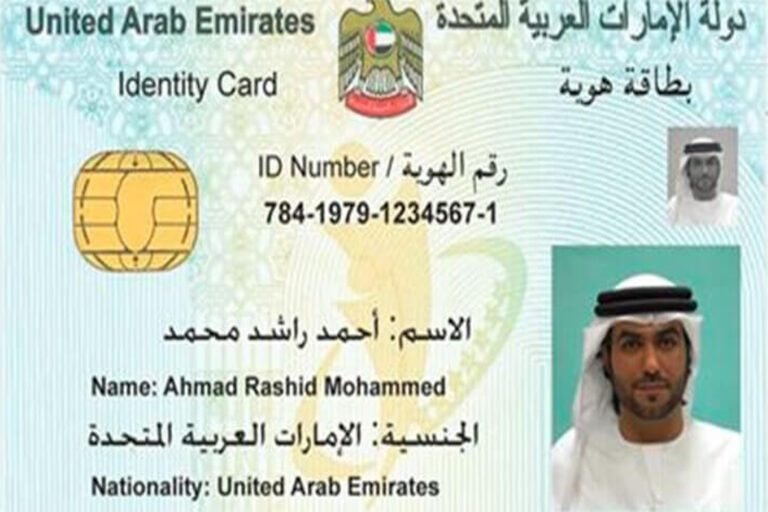

3 Essential Documents for having Health Insurance in UAE

This is how health insurance helping people in UAE:

Health insurance in the UAE is instrumental in enhancing the overall health and well-being of its residents. With a robust healthcare system, health insurance ensures that individuals have access to high-quality medical services without bearing the full brunt of healthcare costs. Here are several ways health insurance is helping people in the UAE:

One of the most significant benefits of health insurance is financial protection. Medical treatments, especially those involving hospital stays, surgeries, or specialized care, can be prohibitively expensive. Health insurance covers a substantial portion of these costs, reducing the financial burden on individuals and families. This protection is crucial in a country where healthcare expenses can escalate quickly.

It provides access to a wide network of healthcare providers, including hospitals, clinics, and specialists. Insured individuals can receive treatment from top-tier medical facilities and professionals. This access ensures that patients receive timely and effective care, improving health outcomes. Preventive services, such as vaccinations and regular health screenings, are often covered, promoting early detection and management of health issues.

Having health insurance fosters a sense of security and peace of mind. Knowing that medical expenses will be covered allows individuals to focus on their work and personal lives without the constant worry of potential healthcare costs. This sense of security contributes to mental well-being and reduces stress, which can positively impact overall health.

Health insurance also contributes to public health improvement. With more people covered, there is a greater emphasis on preventive care and early treatment, which can reduce the incidence and severity of illnesses. This collective health improvement can lead to lower healthcare costs in the long term and a healthier population overall.

Health Insurance FAQ

iNSURA.ae powered by PIONEER provides a range of health insurance plans, including individual coverage, family plans, and specialized plans to meet diverse healthcare needs. Our plans are designed to offer comprehensive protection and flexibility.

Obtaining a health insurance quote is easy. Simply visit our website and fill out the online quote form. Provide relevant information about your health needs, and we’ll generate a personalized quote tailored to your requirements.

In the event of a medical expense, you can easily file a claim through our online portal or by contacting our dedicated claims team. We aim to process claims efficiently, ensuring you receive timely assistance.

Policy renewal is made easy with iNSURA.ae powered by PIONEER. You can renew your health insurance in UAE online through our user-friendly platform. We’ll also send you timely reminders to ensure continuous coverage.

If you have additional questions or need assistance, our customer service team is here to help. Contact us through our website, via email, or by phone. Visit our “Contact Us” page for detailed information on how to reach us.

Our Insurance

Download

Make your dream life get professional help

Choose iNSURA.ae Now!

Extensive Network Coverage

Fast Claim Settlements

Comprehensive Hospitalisation Benefits

Seamless Cashless Hospitalization