Health Insurance

Health Insurance in UAE to save your medical expenses in. We are providing quotes from top insurance companies. Avail the offers & benefits of our health insurance services. Get your peace of mind now.

Health Insurance in UAE: Your Medical Expense Savior!

What is Health Insurance?

Health insurance in the UAE is a financial product that helps cover the costs of medical care. It protects you from unexpected expenses related to hospital visits, surgeries, doctor consultations, and other healthcare services. With the right health insurance in the UAE, you no longer have to worry about paying out-of-pocket for expensive treatments.

Types of Health Insurance in the UAE

There are several types of health insurance available in the UAE, which are customised according to your requirements and necessity.

Types are as follow:

- Critical Illness Health Insurance

- Senior Citizen Health Insurance

- Individual Health Insurance

- Family Health Insurance

Critical Illness Health Insurance

Critical illness insurance provides essential financial protection when life takes an unexpected turn. Designed to cover serious health conditions such as cancer, heart attacks, or strokes, it offers a safety net during challenging times. With this coverage, you can focus on recovery instead of worrying about mounting medical expenses. In the UAE, critical illness coverage is typically includes within comprehensive health insurance plans, ensuring access to the care you need without financial stress. It’s about securing peace of mind for you and your loved ones, making sure that unexpected health challenges don’t disrupt your future plans or stability.

Senior Citizen Health Insurance

Senior citizen health insurance plans provide crucial coverage for your parents or loved ones during medical emergencies. These policies offer benefits like cashless hospitalization, covering everything from doctor consultations and ICU charges to operation theatre costs and even dental care. They also extend coverage for diagnostic tests and ambulance services. What makes these plans indispensable is the financial security they provide, ensuring you don’t have to worry about out-of-pocket expenses during critical moments.

Individual Health Insurance

Individual health insurance plans are tailored to offer financial support during medical emergencies, ensuring you have coverage when it matters most. Available for anyone aged 18 and above, this plan is offer by top health insurance providers across the UAE. They typically cover expenses such as hospitalization, medical treatments, and other significant healthcare costs. What makes these plans even more appealing is their flexibility—they can often customized to suit your unique needs and budget, giving you peace of mind and the assurance of quality healthcare when needed.

Family Health Insurance

A family health insurance plan provides comprehensive coverage for your family members during medical emergencies. These plans come with valuable benefits, including cashless hospitalization for procedures like doctor consultations, ICU stays, and surgery costs. It also cover maternity care, dental treatments, diagnostic tests, and ambulance charges.

Why You Should Buy Health Insurance?

- Financial Protection: With the right health insurance in the UAE, you don’t have to worry about the rising costs of medical treatments. It provides you with financial protection from unexpected medical bills, ensuring you don’t face a financial crisis when you need medical care.

- Comprehensive Coverage: Health insurance covers a wide range of medical services, from doctor visits to surgeries and even emergency care. You get the care you need without the added stress of figuring out how to pay for it.

- Emergency Medical Assistance: Accidents and emergencies can happen at any time. Health insurance ensures that you receive immediate medical attention when needed, even in critical situations.

- Quality Health Care: With health insurance, you have access to the best healthcare providers in the UAE. You can get high-quality medical treatment without having to worry about the costs.

- Preventive Care: Health insurance in the UAE often includes coverage for routine check-ups and preventive care, helping you avoid serious health conditions before they become costly.

- Specialist Consultation: Need to see a specialist? Health insurance helps cover specialist consultations, ensuring you receive expert care when required.

- Maternity Benefits: Planning to start a family? Our health insurance plans include maternity benefits, covering prenatal, delivery, and postnatal care.

- Mental Health Support: Health insurance also provides coverage for mental health services, including therapy and counselling, so you can take care of your mental well-being

Why Choose Health Insurance with Insura.ae?

- Wide Choice: We offer a range of health insurance in the UAE options tailored to fit your lifestyle, needs, and budget. We have you covered whether you’re seeking family or individual coverage.

- Expert Advice: Our team of insurance experts will help guide you through the process, ensuring you choose the best plan for your health and financial situation.

- No-Claim Bonus: By maintaining a healthy lifestyle and not filing a claim, you can benefit from our no-claim bonus, giving you additional savings on your premiums.

- Fast Claim Settlement: We ensure that your claims are processed quickly and efficiently, so you can focus on getting the care you need, not dealing with paperwork.

- Cashless Hospitalization: Our network of hospitals and clinics allows you to receive treatment without paying upfront. With cashless hospitalization, you can focus on your recovery instead of the financial burden.

Key Features of iNSURA's Powered by Pioneer Health Insuarnce:

| Key Features | Insurance Benefits |

|---|---|

| Health Insurance Price | Starting at Just @ 4 AED / Per Day |

| Coverage Amount | 1 Million AED |

| Minimum Health Insurance Entry Age | 0 Yrs |

| Maximum Health Insurance Entry Age | 99 Yrs |

| Process to Apply | Visit Insura.ae fill the form then our Health Insurance Manager Directly Contact You. |

| Health Insurance Claim Procedure | Cashless / Reimbursement |

| Health Insurance is important for | Self, Family, Worker or Domestic Worker, Investor |

| Health Insurance Covered | In-Patient Service, Out-Patient Service, Maternity Coverage, Dental Cover |

| Purchase / Renew Process | Online |

When to Buy Health Insurance?

It’s recommended to get a trusted health insurance in the UAE as soon as you move to the UAE, as pre-existing conditions may not be covered for 30 to 90 days. Early coverage ensures you’re protected after this waiting period. If you plan to start a family, look for insurance that includes maternity and childcare coverage to be better prepared for health needs.

Things to Know Before Buying Health Insurance in the UAE

- Types of Health Insurance: Understand the different types of plans available, from individual to family or group coverage.

- Policy Coverage: Check what’s included in your health insurance policy. Are hospital visits, surgeries, and specialist consultations covered?

- Eligibility Criteria: Ensure that you meet the eligibility requirements for the policy you’re interested in.

- Budget: Set a budget for your health insurance premiums. We offer flexible plans to suit every financial situation.

- Customer Feedback: Read customer reviews to see how our services have helped others. Our satisfied customers can attest to the quality of our plans.

- No-Claim Bonus: Ask about our no-claim bonus and how it can reduce your premiums.

- Claim Process: Understand the process for making claims, ensuring you know exactly what steps to take when you need medical assistance.

What is Covered Under Health Insurance

- In-Patient Service:- Covers hospital stays, surgeries, and other inpatient treatments.

- Out-Patient Service:- Covers consultations with doctors and treatments that don’t require hospitalization.

- Maternity Coverage:- Covers prenatal, delivery, and postnatal care.

- Pre-existing and Chronic Conditions:- Depending on the plan, pre-existing conditions and chronic illnesses may be covered after a waiting period.

- Emergency Cases:- Emergency medical situations, such as accidents or sudden illnesses, are fully covered.

What is Not Covered Under Health Insurance?

- Surgical and Non-Surgical Treatment for Obesity: Weight loss treatments are not typically covered.

- Cosmetic Surgeries: Elective cosmetic surgeries are excluded from coverage.

- Growth Hormone Therapy Unless Medically Suggested: Non-medical use of growth hormone therapy is not covered.

- Services and Treatment for Contraception, Sex Transformation, or Sterilization. Health insurance does not cover these therapies.

- External Prosthetic Devices and Medical Treatment: These devices and related treatments are usually not covered.

- Treatment Required Due to Injuries Caused by Professional Sports Activities: Injuries sustained during professional sports are excluded from coverage.

Eligibility Criteria

For Adults – 18 to 99 years.

For Dependent Children – From birth to 17 years.

Pre-Existing Health Condition Waiting Period – 6 months.

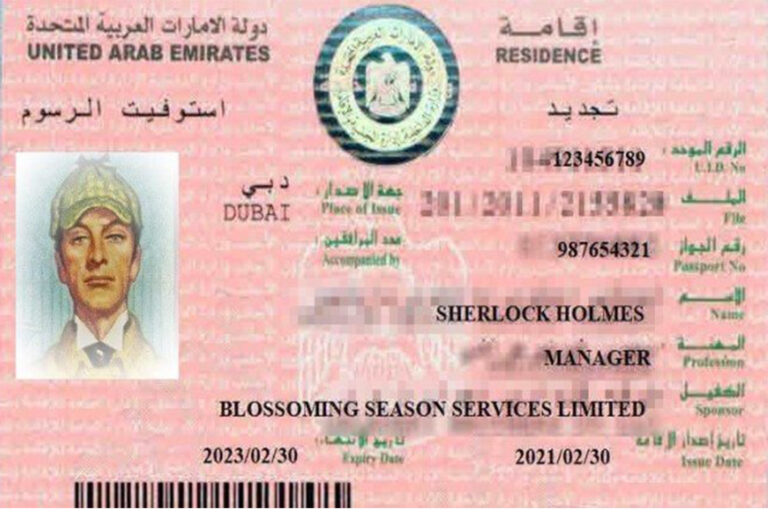

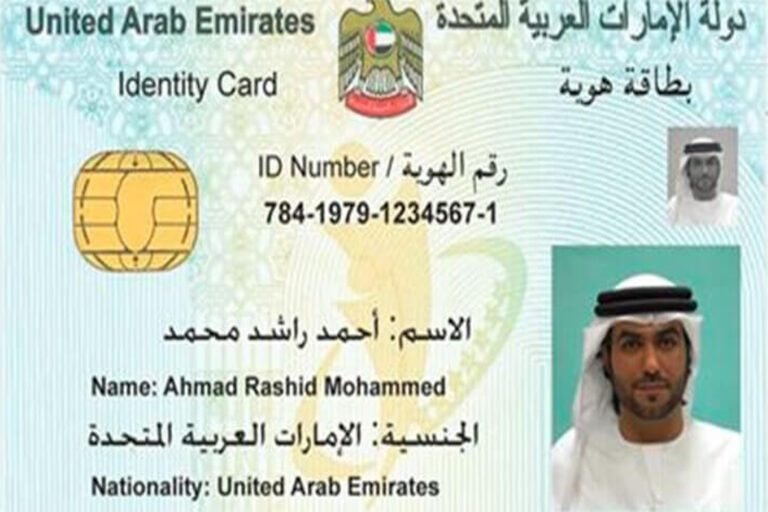

3 Essential Documents Required for Health Insurance in UAE

Original Emirates ID: Ensure your Emirates ID is up to date for verification.

Original Passport: Your passport is required for identification purposes.

Original Residency Visa: Applicable to expatriates for residency verification.

Frequently Asked Question's

iNSURA.ae powered by PIONEER provides a range of health insurance plans, including individual coverage, family plans, and specialized plans to meet diverse healthcare needs. Our plans are designed to offer comprehensive protection and flexibility.

Obtaining a health insurance quote is easy. Simply visit our website and fill out the online quote form. Provide relevant information about your health needs, and we’ll generate a personalized quote tailored to your requirements.

In the event of a medical expense, you can easily file a claim through our online portal or by contacting our dedicated claims team. We aim to process claims efficiently, ensuring you receive timely assistance.

Policy renewal is made easy with iNSURA.ae powered by PIONEER. You can renew your health insurance in UAE online through our user-friendly platform. We’ll also send you timely reminders to ensure continuous coverage.

If you have additional questions or need assistance, our customer service team is here to help. Contact us through our website, via email, or by phone. Visit our “Contact Us” page for detailed information on how to reach us.

Our Insurance

Download

Make your dream life get professional help

Choose iNSURA.ae Now!

Extensive Network Coverage

Fast Claim Settlements

Comprehensive Hospitalisation Benefits

Seamless Cashless Hospitalization