Table of Contents

ToggleDid you know that your health insurance in the UAE might come with a hidden gem — free medical checkups? It’s not just about covering hospital bills or emergency treatments; many health insurance providers offer routine tests like blood pressure checks, blood sugar tests, and even doctor consultations without any extra cost. These checkups, usually available once a year depending on your policy, are more than just a bonus — they are essential for catching health issues early and keeping your well-being on track.

But here’s the catch — not everyone knows how to access these free services, and some may not even realize they exist. Whether you already have health insurance in the UAE or you’re still considering getting a plan, understanding these free medical benefits can save you from unexpected health surprises and financial stress.

In this guide, we’ll explain why regular health checkups matter, how often you can use this benefit, the tests typically covered, and the simple steps to claim your free checkup.

Let’s clear the confusion and ensure you’re getting the most out of your Health Insurance in the UAE. Keep reading about your health (and wallet) will Thank you!

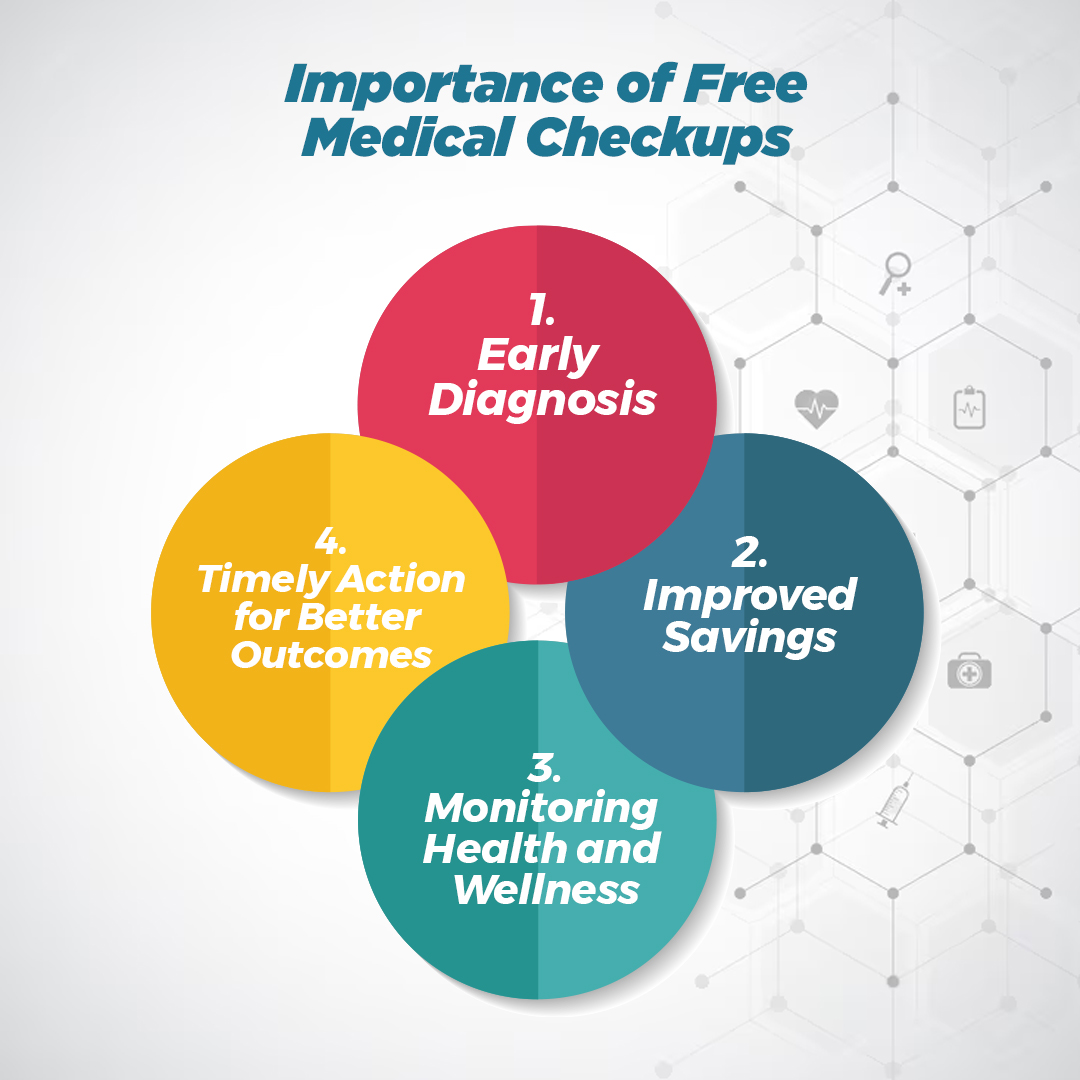

Importance of Free Medical Checkups

Free medical checkups through health insurance in the UAE aren’t just an added perk, they are a powerful tool to protect your health and finances. Let’s break down why these routine Medical checkups matter and how they can safeguard both your well-being and your wallet.

1. Early Diagnosis

Health issues often start small and silently. Routine screenings can detect underlying conditions like high blood pressure, diabetes, or vitamin deficiencies before they turn into bigger, more expensive problems. Imagine finding out you have high cholesterol early with simple lifestyle changes, you avoid the risk of a heart attack later.

2. Improved Savings

Medical crises can quickly deplete your savings. But catching a condition early through a free checkup can save you from costly hospital visits and treatments. For example, treating type 2 diabetes in its early stages is far cheaper than managing complications like kidney damage or heart disease later on. By using the free checkups offered by your health insurance in the UAE, you cut down future medical expenses and protect your financial stability.

3. Monitoring Health and Wellness

Regular checkups give you a clear picture of your current health status. They help track vital signs, detect gradual changes, and guide you in making informed lifestyle choices. If you’re dealing with ongoing conditions like hypertension or thyroid issues, these tests help you stay one step ahead.

4. Timely Action for Better Outcomes

When a condition is caught early, treatment becomes more effective and less complicated. Instead of waiting for a health scare, free medical checkups ensure you get the right care at the right time. For example, a simple blood sugar test could alert you to pre-diabetes, allowing you to adjust your diet and avoid full-blown diabetes.

Understanding these benefits is just the first step. Next, let’s look at how often you can take advantage of these free medical checkups with your health insurance — so you never miss a beat when it comes to your health!

How Often Can Someone Get Free Medical Checkups with Health Insurance?

Wondering how often you can use free medical checkups with health insurance in the UAE? The answer depends on your policy, but most health insurance providers offer these checkups at least once a year. This means you have a yearly opportunity to stay ahead of any potential health issues without spending extra.

However, the frequency can vary. While annual checkups are standard, some insurers might offer additional screenings based on your age, medical history, or the type of plan you hold. If you have a comprehensive policy, you might even be eligible for bi-annual checkups or specialist consultations at no added cost.

To know exactly how often you can schedule your free checkups, it’s best to review your health insurance policy or reach out directly to your provider. They can give you a clear breakdown of what’s covered and how frequently you can use these services.

Staying informed about these details helps you make the most of your insurance and your health. Now, let’s explore the list of free medical checkups.

List of Free Medical Tests Covered in Health Insurance

These tests help detect hidden health issues early, keeping you one step ahead of any serious conditions. Let’s break down some of the most common tests you can access through your health insurance:

- Blood Pressure Test: A quick and simple way to check for hypertension or low blood pressure, helping prevent heart-related issues.

- Complete Blood Count (CBC): This test assesses your overall health by measuring different components of your blood and detecting infections or anaemia.

- Chest X-rays: Essential for identifying lung problems like infections, asthma, or other respiratory conditions.

- Vitamin Deficiency Examinations: Pinpoint a lack of vital vitamins like D or B12, which can impact energy levels, immunity, and overall health.

- Blood Sugar Test: Crucial for detecting diabetes or prediabetes, allowing for early intervention and management.

- Lipid Profile: Monitors cholesterol levels to assess heart health and the risk of stroke or heart disease.

- General Physical Examination: A routine check to review your overall well-being, often including weight, height, and other basic health metrics.

- Kidney Function Test: Identifies any issues with your kidneys by measuring how well they’re filtering waste from your blood.

- Lung Function Test: Evaluate your breathing and lung capacity, especially useful for smokers or those with asthma.

- Urine Test: Detects infections, kidney disease, or signs of other underlying conditions through a simple urine sample.

The exact tests covered can differ based on your health insurance plan. To get a full list of what’s included, review your policy documents or speak directly with your insurance provider.

Now that you know what to expect, let’s dive into what are the factors that affect free medical checkups!

Factors That Affect Free Medical Checkup Benefits

Did you know that several factors influence whether you qualify for free medical checkups under your health insurance in the UAE? Understanding these can help you make informed decisions and maximise your health benefits. Let’s break it down:

Insurance Company

Each insurance provider has its own rules for free medical checkups. While some insurers offer annual checkups, others may have stricter terms. If you don’t compare policies, you might end up missing out on essential preventive care. Always review the benefits before choosing a plan.

Claim-Free Years

Many insurers reward policyholders who don’t make claims for a certain period — often 4 to 5 years — by offering free health checkups. If you frequently claim for medical expenses, you may lose this benefit. Staying healthy and avoiding unnecessary claims could mean more preventive care options.

Amount of Sum Insured

The sum insured directly impacts the number and type of free medical tests you can access. Higher coverage plans often include more comprehensive checkups. If you opt for basic coverage, you may only get limited tests. Choosing a plan with a higher sum insured could open doors to better preventive healthcare.

To make the most of your health insurance, always check the policy details, especially regarding free medical checkups. Now, let’s move on to how you can easily schedule these tests and take control of your health.

How to Apply for Free Medical Checkups

Getting free medical checkups through your health insurance in the UAE is simple if you follow the right steps. Let’s break it down so you can claim your benefits without any hassle.

Step 1: Contact Your Insurance Company

Reach out to your insurance provider by calling customer care or visiting their nearest branch. Mention that you want to use your free medical checkup benefit. Many people in the UAE miss out on these services simply because they’re unaware or unsure of how to begin—don’t let that be you.

Step 2: Schedule an Appointment

Once your insurance provider confirms your eligibility, schedule a medical checkup appointment. Choose a date and time that fits your schedule. Delaying this step can mean missing out on timely health screenings, which can prevent the early detection of potential issues.

Step 3: Get an Authorization Letter

Ask your insurer for an authorization letter — this is usually a must-have for the medical facility. Without it, you might face confusion or even be charged for tests that should be covered. Double-check that all details are correct to avoid any last-minute issues.

Step 4: Attend Your Appointment

Go to the approved clinic or hospital at the scheduled time and complete your tests. Ensure you carry all necessary documents, like your insurance card and authorization letter. Missing paperwork could result in delays or unexpected costs.

Step 5: Submit Test Reports (If Required)

In some cases, you may need to submit your test reports to your insurer. This step ensures everything is recorded correctly in your health insurance file. Usually, the insurer covers the costs directly, so you won’t have to pay anything upfront — but always confirm this to avoid surprise bills.

Following these steps keeps the process smooth and stress-free. Now that you know how to apply, let’s move on to understanding why using these free checkups regularly is crucial for your well-being.

Conclusion

Regular health checkups aren’t just about spotting issues early — they’re about staying in control of your well-being and avoiding costly surprises. We’ve explored how free medical checkups through health insurance can safeguard your health, save you money, and guide you toward timely treatments.

If you have health insurance, why not use these benefits to their fullest? And if you don’t, what’s stopping you from getting the coverage that keeps both your health and wallet secure?

Take the first step — when was the last time you scheduled your free health checkup?

Frequently Asked Question's

How to get free medical treatment in the UAE?

You can get free or subsidised medical treatment at government hospitals with a health card or through your health insurance plan.

How to check what is covered in your health insurance in the UAE?

Review your policy documents or contact your insurance provider directly to check what treatments and services are covered.

Where is the cheapest place to see a doctor?

Government clinics and hospitals usually offer the most affordable consultations, especially if you have a health card or basic health insurance in the UAE.

What does medical insurance cover in the UAE?

Medical insurance typically covers doctor consultations, emergency care, hospitalisation, and basic tests — the extent depends on your plan.

How to check UAE medical insurance?

You can check your medical insurance details through your insurer’s app, website, or by visiting their customer service centre.