How To Deal With The Stress In The UAE’s Working Environment

Table of Contents

ToggleLife in the UAE moves fast—long working hours, rising living costs, and constant pressure to keep up are stressful. But have you noticed how much of this stress comes from money? Learning how to deal with the stress of unexpected medical bills, job loss, or a sudden emergency can feel overwhelming.

Financial stress isn’t just about struggling with money — it’s the sleepless nights worrying about “what if” moments.

What if I lose my job?

What if I can’t afford a medical emergency?

These thoughts build up, making it hard to focus at work or enjoy time with family.

But here’s the good news: you can ease this stress. One simple yet powerful answer to the question of how to deal with the stress is securing the right insurance. It protects you from life’s uncertainties, giving you the peace of mind you deserve. Let’s break down how financial stress impacts your life and how the right insurance can help you live worry-free.

The High-Stress Lifestyle in the UAE

Living in the UAE comes with a unique set of challenges, especially when it comes to balancing work and personal life. Whether you’re an employee in a fast-paced job or a homemaker managing family responsibilities, stress can quickly become overwhelming.

Heavy Workload

The pressure to take on a heavy workload, often extending beyond the usual hours and even into weekends, can easily lead to burnout. For expatriates especially, this becomes a cycle of constantly striving to prove dedication to employers. The financial stress of managing bills, saving for the future, and keeping up with an expensive lifestyle only adds to the strain.

Competitive Job Market

The job market in the UAE is highly competitive, with many expatriates battling for limited opportunities. The constant pressure to stand out often makes employees feel the need to work longer hours to demonstrate their commitment. Coupled with the financial pressure of meeting rent, healthcare, and daily expenses, it’s easy to sacrifice personal time and well-being, which contributes to ongoing stress. It’s not just job performance that suffers; mental and physical health begins to take a toll as well.

These stressors, particularly in a financial context, can quickly begin to feel overwhelming. The good news is that acknowledging these challenges is the first step toward how to deal with the stress. In the next section, we’ll look at how these stressors impact your health and why securing the right insurance can give you the peace of mind you deserve.

Financial Stress: A Silent Aggravator

We often talk about stress in terms of workload, deadlines, and personal challenges, but one silent stressor many face in the UAE is financial strain. It’s an invisible burden that can have a profound impact on your mental health and daily life.

Definition and Causes

Financial stress refers to the anxiety and pressure people feel when they face challenges in managing their finances. It can stem from unexpected expenses like medical bills or car repairs, the lack of sufficient savings for emergencies, or simply poor financial planning. Many people find themselves living paycheck to paycheck, with little or no buffer for unexpected costs. This constant financial uncertainty creates stress, making it difficult to focus on anything else.

Impact on Mental Health

The toll of financial stress isn’t just on your wallet — it affects your mental health as well. It can lead to anxiety, depression, and feelings of helplessness. The constant worry about money can disrupt sleep, reduce productivity at work, and strain relationships. For many, the fear of not having enough funds to cover essential needs can feel overwhelming, leading to a vicious cycle of mental and emotional exhaustion.

Financial stress isn’t just something you “get used to” over time. If not addressed, it can grow and start affecting your overall well-being. Now that we understand how financial stress impacts your mental health, let’s explore how securing the right insurance can provide a much-needed safety net to ease your mind and protect you from future uncertainties.

How Insurance Help to Mitigate Financial Stress

When life throws unexpected challenges your way, having the right insurance can be a game-changer. Insurance isn’t just a financial product; it’s a powerful tool that can provide relief and ease the pressure when things go wrong.

Safety Net Against Uncertainties

Insurance acts as a safety net, offering financial protection against unexpected events like medical emergencies, accidents, or property damage. Imagine facing a sudden illness or car accident without coverage — the medical bills or repair costs could be a financial nightmare. But The right insurance covers unforeseen expenses, preventing financial disasters. It keeps you from being financially overwhelmed by life’s curveballs, allowing you to focus on what truly matters.

Peace of Mind

Knowing you have appropriate insurance coverage can significantly reduce the anxiety that comes with financial uncertainty.Being covered eliminates the fear of “what if” scenarios, giving you the mental peace to live your life without constant worry. Whether it’s health, life, or car insurance, having that safety net allows you to handle challenges with confidence, knowing you’re not alone in managing the financial burden.

By securing the right insurance, you can reduce the financial stress that weighs heavily on your mind. In the next section, we will discuss which insurance can help you get the answer to how to deal with the stress.

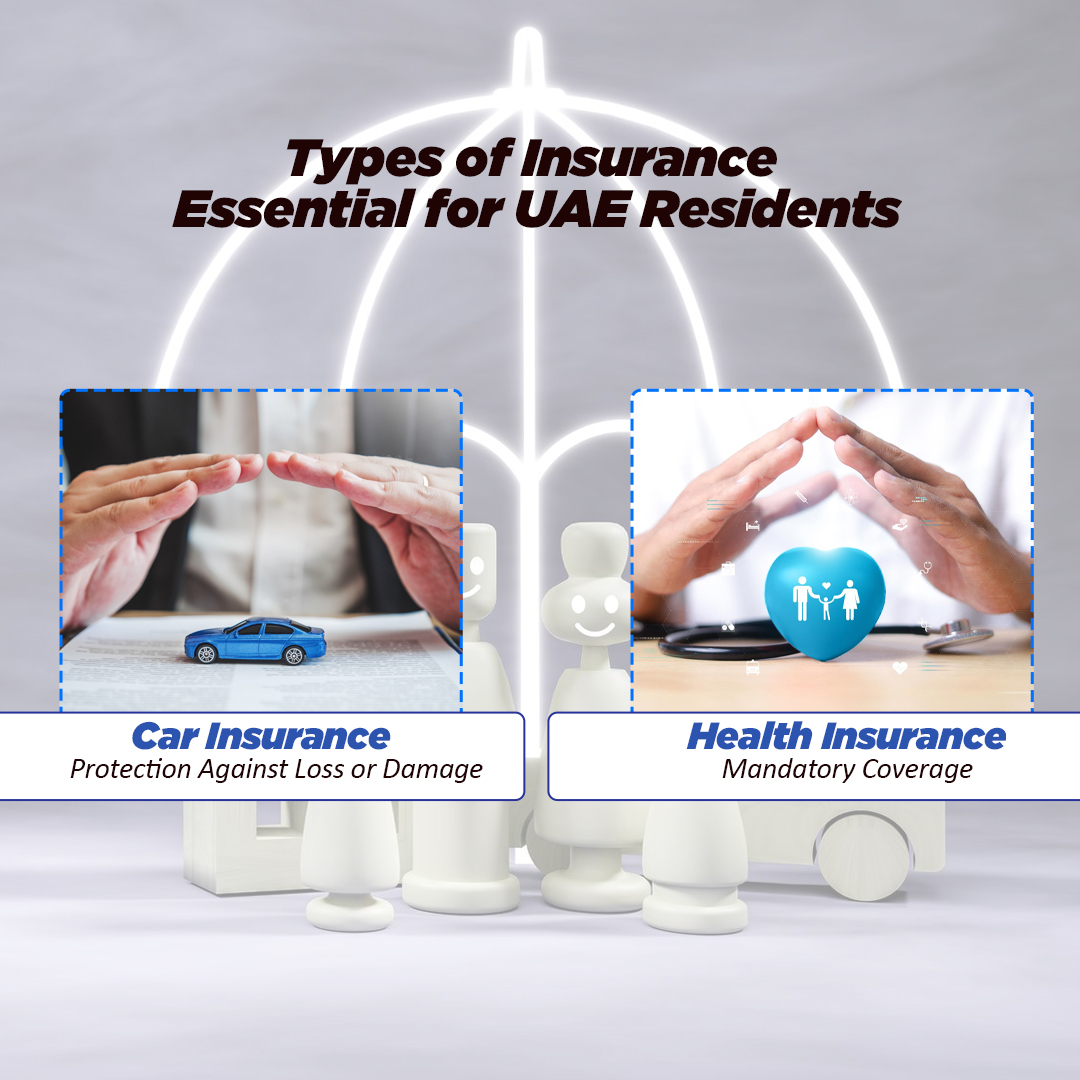

Types of Insurance Essential for UAE Residents

In the UAE, where life can be fast-paced and full of surprises, having the right insurance coverage is more than just a precaution. From health to car insurance, these essential policies help protect against unexpected financial burdens and offer peace of mind.

Health Insurance: Mandatory Coverage

Health insurance is mandatory for all UAE residents, and employers are required to provide it for their employees. Companies offer a range of plans tailored to the needs of citizens and expatriates alike. Without health insurance, the cost of medical care can quickly become overwhelming, adding another layer of stress. Whether it’s routine check-ups or emergencies, health insurance ensures that you’re covered when unexpected health issues arise.

- Comprehensive Health Plans: Opting for Comprehensive Health Insurance plans offers a broader range of services, ensuring you have access to a wide variety of medical treatments and specialists. A comprehensive plan can cover everything from doctor visits and surgeries to medications and hospital stays.

Car Insurance: Protection Against Loss or Damage

Car insurance is a must-have in the UAE, as the cost of repairing or replacing a vehicle after an accident or theft can be significant. Without insurance, you could be left facing hefty bills, causing unnecessary financial stress. Having car insurance protects you from these costs, ensuring that your vehicle is covered for damages, accidents, or even theft. It helps to keep your finances stable, whether you’re involved in a minor fender bender or a major collision.

- Car Insurance for Peace of Mind: With car insurance, you can drive with confidence, knowing that you’re protected against unexpected costs. Whether it’s a parking lot scrape or an accident on the highway, car insurance helps ease the financial strain, allowing you to focus on the road ahead.

Now that we’ve explored the essential types of insurance for UAE residents, it’s time to take the next step and secure the right coverage for your needs. Here’s how you can practically approach finding the best insurance to protect yourself and your family.

Practical Steps to Secure Appropriate Insurance

Now that we understand how insurance can help alleviate stress, it’s essential to take practical steps to secure the right coverage for yourself and your family.

1. Assess Personal Needs

- The first step is assessing your personal and family requirements to determine the insurance coverage that best suits your situation.

- Consider factors like age, health, family size, and any specific risks that might apply to your lifestyle.

- Evaluating your needs helps to prevent you from overpaying for unnecessary coverage or, conversely, leaving gaps that could leave you exposed in an emergency.

2. Compare Policies

- Once you’ve identified your needs, it’s time to compare different policies.

- The UAE offers a variety of insurance options, and not all of them are the same.

- Take time to research different insurers, plans, and the coverage each one offers.

- Comparing prices, benefits, and exclusions ensures that you choose the right policy for your financial situation and future goals.

3. Consult Experts

- If you’re unsure about which insurance policy is right for you, consulting experts like – insura.ae can help make the process easier.

- Financial advisors and insurance brokers have the experience and knowledge to guide you through the complexities of choosing the right plan.

- They can offer insights into what’s truly essential, recommend reputable insurance providers, and help you navigate any fine print.

Taking these practical steps to secure appropriate insurance is a smart way to tackle the financial uncertainties that contribute to stress. By evaluating your needs, comparing policies, and seeking expert advice, you’ll be well on your way to reducing stress and living a worry-free life.

Conclusion

In conclusion, understanding the impact of financial stress and how insurance can help mitigate it is crucial for living a peaceful and stress-free life in the UAE. By securing the right coverage, whether it’s health, life, or car insurance, you create a safety net that protects you from unexpected financial burdens. With the right insurance in place, you can manage stress more effectively, knowing that you and your family are covered for any uncertainties that come your way.

Now, it’s time to take action. How to deal with the stress of financial uncertainties starts with evaluating your insurance needs and securing appropriate coverage. Don’t wait until it’s too late – take proactive steps today for a secure and stress-free future.

Are you ready to make the change and protect your peace of mind with the right insurance? Let’s get started!

Frequently Asked Question's

How do you handle stress in the workplace?

Manage workplace stress by staying organised, setting clear priorities, and securing the right insurance to ease financial worries.

How would you handle working in a high-stress environment?

Handle high-stress environments by planning ahead, maintaining work-life balance, and protecting finances with reliable insurance.

What are 5 signs of work-related stress?

Work-related stress appears as constant worry, fatigue, poor concentration, mood swings, and sleep problems—often linked to financial pressure.

What are 3 ways to reduce workplace stress?

Reduce workplace stress by managing time effectively, seeking support, and securing insurance to prevent unexpected financial burdens.

How to beat stress?

Beat stress by staying proactive—plan finances, secure insurance, and focus on what truly matters.