How Common Life Insurance Riders Help To Increase Your Coverage Easily?

Table of Contents

ToggleFrom the fast food we grab on the go to the hours spent hunched over screens, our modern lifestyle is rewriting the rules of health—and not in our favour. These changes don’t just impact our well-being—they pose a direct threat to our financial security.

While eating healthy and staying active are vital, safeguarding your financial future is equally important. Life insurance is a crucial step, but relying solely on a standard plan is like trying to weather a storm with an umbrella that’s too small. This is where common life insurance riders come in—offering enhanced protection tailored to your unique needs.

In this blog, we’ll discover how riders work, their importance in today’s uncertain world, and the types available to fit your lifestyle. Whether you’re already insured or considering your first policy, this guide will help you make informed decisions to secure your future and enjoy peace of mind.

How Does a Life Insuarnce Rider Work?

Riders are like add-ons or extensions to your life insurance policy, providing extra benefits beyond standard coverage. They are perfect solutions designed to address specific risks, such as critical illnesses or accidental disabilities, that could derail your financial stability. A rider ensures your policy evolves with your needs, offering you better security for life’s uncertainties.

Why Your Life Insuarnce Policy Might Need a Boost

Imagine facing a sudden health crisis—such as a heart attack or cancer diagnosis—armed only with a basic life insurance plan. The standard policy payout might provide long-term family support, but it doesn’t cover hefty medical bills or income loss during recovery.

This is where a critical illness rider steps in, offering financial relief when you need it the most. Without it, you might find yourself dipping into savings, delaying dreams, or even compromising on the quality of care.

Now that you understand how riders work, it’s time to explore their impact. In the next section, we’ll delve into why riders are essential for financial security and how they provide peace of mind in today’s rapidly changing world.

Importance of Common Life Insurance Riders

Modern life is unpredictable, and your insurance coverage should reflect that. As lifestyle diseases become more common and accidents can upend lives in an instant, relying solely on basic life insurance might leave you vulnerable. Common life insurance Riders offer enhanced protection, ensuring that your policy adapts to your needs. Let’s explore why riders are a must-have for a secure and worry-free future.

1. Provide Financial Security

- Riders shield you from unexpected financial shocks caused by health crises or accidents.

- A critical illness rider, for instance, offers a lump sum payout upon diagnosis, covering treatment expenses and income loss.

- Example: Without a rider, covering cancer treatment costs could mean draining your savings or taking loans. With one, your finances remain intact while you focus on recovery.

2. Help to Get the Best Treatment

- Riders ensure access to premium healthcare facilities without financial stress.

- A hospital cash add-on rider covers daily hospitalisation expenses, allowing you to choose better treatment options.

- Example: Opting for a private hospital room or advanced procedures becomes feasible when your rider takes care of the costs.

(Note: In the case of Term Life Insurance, it is not applicable.)

3. Boost the Coverage

- Common life insurance Riders enhance your payout in emergencies, providing additional security for your loved ones.

- An accidental death benefit rider increases the payout in case of an accidental demise, offering crucial financial support.

- Example: This ensures your family maintains their lifestyle and achieves future goals even in your absence.

4. Tax Benefits

- Rider premiums often qualify for tax deductions, offering savings while securing your future.

- Example: In the UAE, these deductions allow you to reduce taxable income, creating financial relief and enabling better planning.

5. Flexibility to Meet Unique Needs

- Common life insurance Riders are highly customisable, letting you tailor your coverage to match your priorities.

- Whether it’s a waiver of premium rider for disability or a hospital cash rider for frequent medical needs, you can choose what fits your lifestyle.

- Example: A young professional may prioritise critical illness coverage, while a parent might focus on education security for children.

Riders amplify the benefits of your life insurance policy, making it a powerful tool against life’s uncertainties. Next, we’ll discuss the types of riders available and how they cater to specific risks and needs, helping you build a truly comprehensive policy.

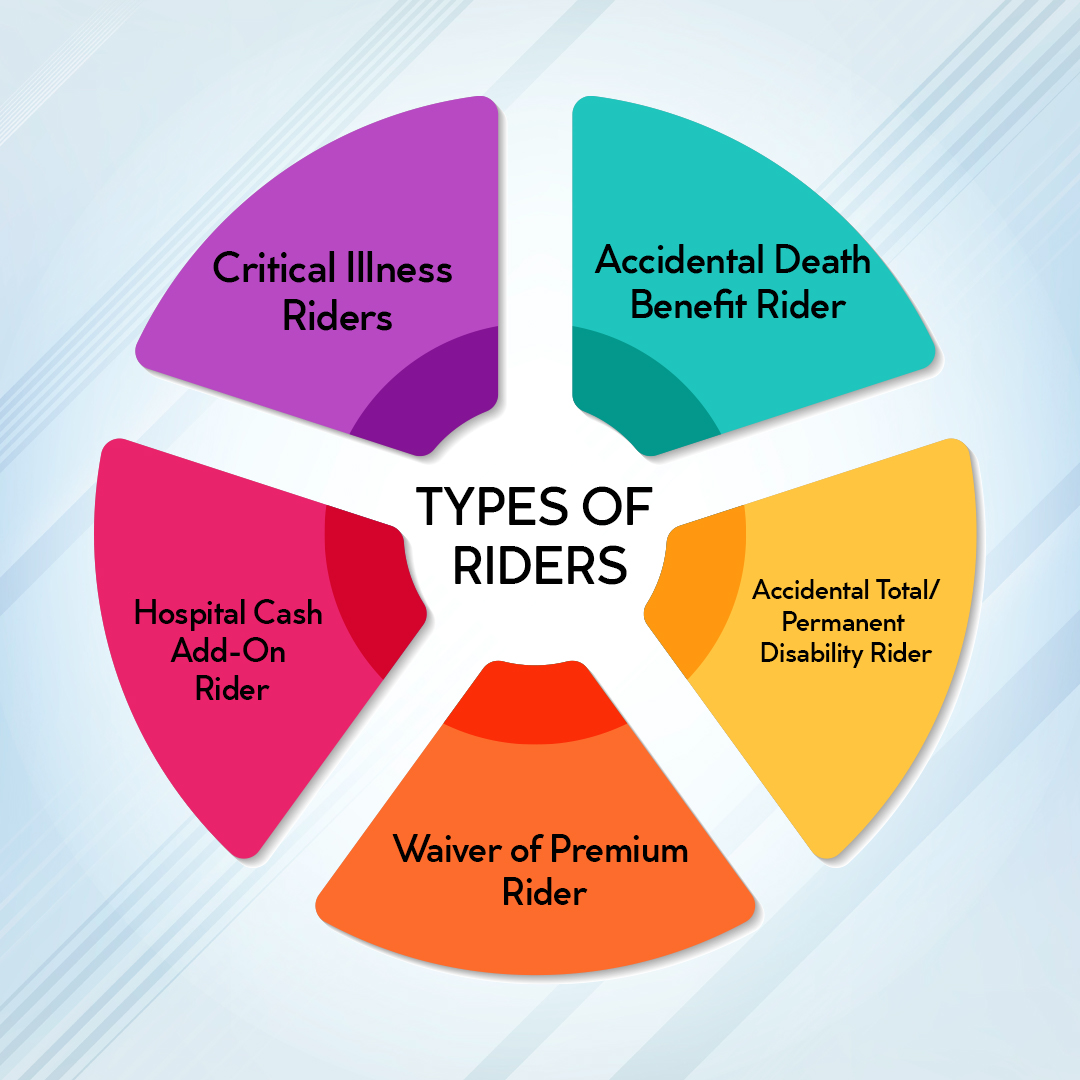

Types of Riders

Common Life insurance riders add significant value to your base policy, ensuring comprehensive coverage for life’s uncertainties. Here are some essential riders that can protect you and your family from unforeseen financial and health challenges.

Critical Illness Riders

- What It Covers: Critical illnesses such as cancer, heart disease, kidney failure, and more.

- How It Helps: Upon diagnosis of a covered condition, you receive a lump sum payout to manage medical expenses.

Example: If diagnosed with cancer, this payout can cover treatment costs, travel to specialised hospitals, or even replace lost income during recovery. Without this rider, these expenses could deplete your savings.

Accidental Death Benefit Rider

- What It Covers: Additional financial payout in case of death caused by an accident.

- How It Helps: This rider ensures your family receives a higher sum assured, providing better financial stability.

Accidental Total/Permanent Disability Rider

- What It Covers: Provides financial support if you become permanently disabled due to an accident.

- How It Helps: This rider replaces income, helping manage day-to-day expenses and long-term care.

Example: A breadwinner who becomes disabled may lose their earning capacity. This rider ensures continued financial stability, covering medical bills and living expenses.

Waiver of Premium Rider

- What It Covers: Waives future premiums in case of a critical illness or permanent disability.

- How It Helps: Ensures the policy remains active even when you are unable to pay premiums.

Example: If you’re diagnosed with a serious illness, this rider allows you to focus on recovery without worrying about policy lapses due to unpaid premiums.

Hospital Cash Add-On Rider

- What It Covers: Offers daily cash benefits during hospitalisation to manage incidental expenses.

- How It Helps: Covers costs like hospital stays, meals, and transport, which are not included in typical policies.

These common life insurance riders not only enhance your insurance but also offer targeted solutions for specific challenges. In the next section, we’ll discuss how Insura simplifies the process of selecting and integrating these riders into your life insurance plan.

How Insura Can Help

Navigating the world of insurance and riders can feel overwhelming, especially when making decisions that shape your family’s future. This is where Insura, a trusted insurance broker in the UAE, steps in to provide clarity and convenience. With an unwavering commitment to simplifying insurance, Insura ensures you receive the protection you need without the stress.

Access to a Wide Network of Insurers

- Collaborating with over 100 leading insurance companies, Insura offers diverse options tailored to meet individual needs.

- This extensive network ensures that every client can find the perfect combination of policies and riders to suit their lifestyle.

Expertise in Rider Selection

- Insura’s team of experienced professionals takes the guesswork out of choosing riders.

- From explaining the benefits of critical illness riders to highlighting tax-saving opportunities, the process becomes effortless.

- By understanding each client’s unique requirements, Insura crafts solutions that provide maximum coverage and peace of mind.

Round-the-Clock Support

- Customer service is available around the clock, so assistance is never far away

- Whether it’s a question about adding a new rider or filing a claim, Insura’s team is ready to assist anytime.

A Customer-Centric Approach

- With a philosophy that places customers at the heart of its operations, Insura delivers tailored solutions that address real-world challenges.

- This approach ensures that every policy and rider aligns perfectly with the client’s goals, protecting them against uncertainties.

Insura transforms the complex into manageable, ensuring comprehensive coverage that adapts to your evolving needs. Explore their offerings and take the first step towards a worry-free tomorrow.

Life Insurance Supports Your Family in Your Absence!

In today’s fast-paced world, where lifestyles are constantly evolving and health risks are on the rise, insurance needs to do more than just cover the basics. Common life insurance Riders bridge the gap, offering targeted protection that safeguards against life’s uncertainties. From financial security during medical crises to ensuring access to premium healthcare, riders enhance your insurance plan in invaluable ways.

Now is the time to increase your current policies and adapt them to the demands of modern living. With riders like critical illness, accidental death benefits, and hospital cash add-ons, you can future-proof your coverage and secure peace of mind for yourself and your loved ones.

Take charge of your financial well-being. Explore our rider options today with Insura and let us help you create a safety net that lasts a lifetime.

FAQ's

What are the benefits of riders in insurance?

Riders enhance your insurance by offering additional protection, financial security, and flexibility to meet specific needs like critical illness or disability coverage.

What riders can increase the death benefit amount?

Accidental death benefit riders and term conversion riders can boost the payout amount for your beneficiaries.

What is the purpose of a rider on a life insurance policy?

Riders provide tailored coverage that extends beyond the standard policy, addressing unique risks like serious illness or income loss due to disability.

Are life insurance riders worth it?

Yes, riders offer valuable add-ons at a minimal cost, ensuring comprehensive coverage for unpredictable life events.

What is the purpose of riders?

Riders customise and strengthen your insurance policy, ensuring it aligns with your evolving lifestyle and financial needs.