Why Family Health Insurance Is Important In The UAE?

Table of Contents

ToggleThe UAE is a fantastic place to live, with a blend of modern cities, thriving career opportunities, and a high standard of living. With world-class healthcare facilities and a lifestyle that balances work and leisure, it’s no surprise that many professionals choose to build their lives and raise their families here. But amidst all the positives, one crucial aspect often gets overlooked: managing healthcare expenses with the support of Family Health Insurance.

Life can be unpredictable, and a medical emergency can disrupt both peace of mind and finances. For those supporting their families, unexpected hospital bills can be overwhelming. Family health insurance goes beyond being just a policy; it acts as a financial shield, protecting your loved ones and helping maintain your budget.

This blog is designed to guide you through the importance of family health insurance in the UAE. We’ll break down how it helps you manage healthcare costs efficiently, why it’s a must-have for every family provider, and who needs a solid plan to ensure your family’s well-being while achieving financial goals. By the end, you’ll have a clear picture of why investing in family health insurance is not just a safety net but a smart financial move. Let’s dive in and take control of your family’s future one informed decision at a time.

What is Family Health Insurance?

Family health insurance is a single policy that covers the medical & hospital expenses of your entire family under one plan. It ensures that all members, whether it’s you, your spouse, children, or even dependent parents, receive the care they need without added financial strain. This type of insurance typically includes Coverage for hospital stays, doctor consultations, surgeries, diagnostic tests, and preventive care. Instead of managing separate policies, you have one streamlined plan that offers both convenience and protection.

Understanding its importance is just the beginning now; let’s explore how family health insurance can help you manage your expenses effectively.

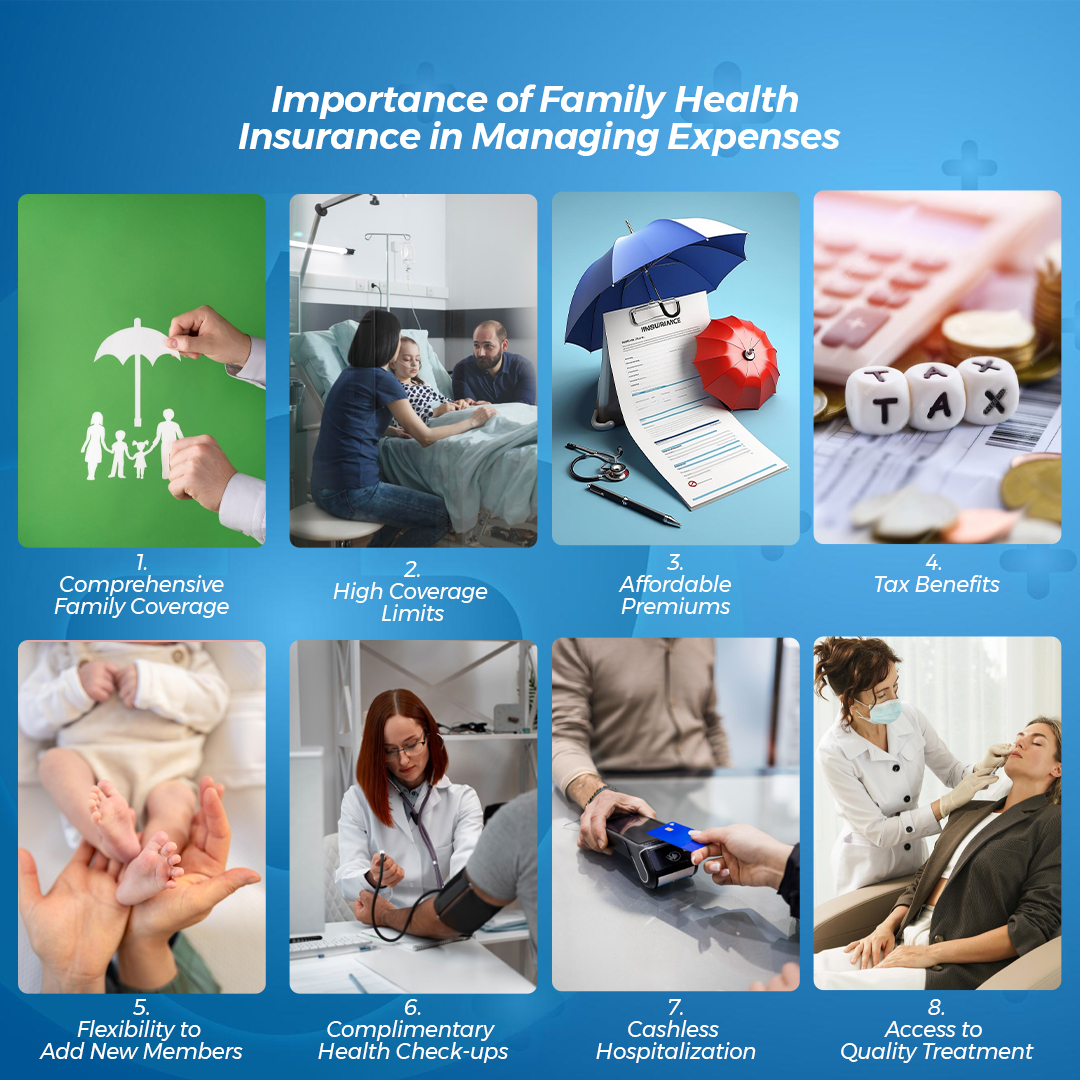

Importance of Family Health Insurance in Managing Expenses

Here are 8 strong reasons for which states that how important it is to have the right family health insurance to manage your expenses like a pro:

1. Comprehensive Family Coverage

A family health insurance plan brings all your loved ones under one umbrella. Instead of tracking multiple policies, you have a single plan that covers everyone, from your spouse to your children. This not only streamlines management but also guarantees uniform Coverage, so no family member is left without protection. Imagine the ease of knowing one policy has everyone covered, eliminating the confusion of handling different insurance plans.

2. High Coverage Limits

Family health insurance often comes with generous coverage limits. This means if a major medical event occurs, like surgery or a critical illness, the policy can absorb most of the expenses. For example, if a family member requires emergency surgery, a high-limit plan can cover hospital bills, specialist fees, and medication costs without you having to dip into your savings. This reduces out-of-pocket expenses and safeguards your financial stability.

3. Affordable Premiums

Opting for a family plan is often more cost-effective than buying individual policies for each member. With a combined premium, you typically pay less per person. For instance, instead of purchasing separate plans for yourself, your partner, and your child, a family policy bundles all these costs into one, making it an affordable way to secure healthcare for everyone. It’s a smart move for those seeking budget-friendly Coverage without compromising protection.

4. Tax Benefits

In the UAE, investing in Health Insurance can sometimes come with tax benefits. Depending on the policy, you might be eligible for deductions or incentives, helping you save even more money. This means not only are you securing your family’s health, but you’re also getting financial relief through reduced tax burdens. Always check with your provider or a financial advisor to understand how your policy can positively impact your taxes.

5. Flexibility to Add New Members

Life changes marriages, births, and more. A family health insurance plan lets you easily add new members. When you welcome a newborn, for example, you can seamlessly include them in your existing policy without the hassle of starting a new plan. This flexibility ensures that as your family grows, their healthcare remains uninterrupted, keeping everyone protected without added stress or expense.

6. Complimentary Health Check-ups

Preventive care is key to managing long-term expenses. Many family health insurance plans offer free regular check-ups, helping catch potential health issues early. Imagine detecting a minor condition before it escalates into something serious. Not only does this protect your family’s health, but it also saves you from costly treatments down the road. Early detection equals lower bills and healthier lives.

7. Cashless Hospitalization

Emergencies don’t wait, and neither should you. With cashless hospitalization, your family health insurance allows you to access treatment at network hospitals without paying upfront. The insurer settles the bills directly with the hospital, reducing immediate financial pressure. Picture rushing a loved one to the hospital — instead of scrambling for cash, you can focus solely on their recovery while the policy takes care of the expenses.

8. Access to Quality Treatment

A solid family health insurance plan ensures your family receives care from reputable healthcare facilities and professionals. This means access to skilled doctors, advanced treatments, and top-tier hospitals — all without the fear of overwhelming costs. When quality care is within reach, you not only protect your family’s health but also maintain financial stability.

Understanding these benefits makes it clear family health insurance isn’t just about handling medical bills. It’s about managing expenses wisely, securing your family’s future, and making informed financial decisions. Let’s now explore how to choose the right plan tailored to your family’s unique needs.

Inclusions and Exclusions of Family Health Insurance

Understanding what your family’s health insurance covers and what it doesn’t is crucial for managing healthcare expenses. Let’s break down the inclusions and exclusions clearly so you know exactly what to expect.

Common Inclusions

- Family health insurance covers Hospital Room Charges costs, whether it’s a shared ward or a private room, so you don’t have to stress over daily fees while focusing on your loved one’s recovery.

- Your insurance plan typically covers consultation fees, allowing your family to seek medical advice or routine check-ups without the extra financial strain.

- Operation Theatre and ICU Charges Medical emergencies often require surgeries or intensive care. Family health insurance covers operation theatre and ICU charges, ensuring you’re not hit with hefty bills during critical moments.

- Many family plans cover daycare procedures like cataract surgeries or chemotherapy, helping you manage costs for minor but essential medical treatments.

- Family health insurance usually includes ambulance services, so you can transport your loved one to the hospital without worrying about unexpected expenses.

- Many family health plans offer maternity coverage, taking care of pre- and post-natal expenses, delivery charges, and even newborn care.

- Dental Coverage Some family health policies extend Coverage to basic dental treatments, such as tooth extractions and fillings.

Common Exclusions

- Pre-existing Conditions (Subject to Waiting Periods) While family health insurance may cover pre-existing conditions, most policies enforce a waiting period.

- Infertility Treatments Treatments like IVF and other infertility procedures are usually not covered.

- Cosmetic Surgeries Unless medically necessary, elective cosmetic surgeries aren’t part of the plan.

- Injuries from High-risk Sports If you or your family members participate in extreme sports like skydiving or rock climbing, be aware that injuries from such activities may not be covered.

- Illnesses Related to Criminal Activities Health issues arising from illegal actions are excluded from Coverage.

- Substance Abuse Treatments Rehabilitation for drug or alcohol abuse is often not included in family health insurance policies.

By understanding these inclusions and exclusions, you can make informed decisions about your family’s healthcare. Now, let’s move on to choosing the right family health insurance plan tailored to your needs.

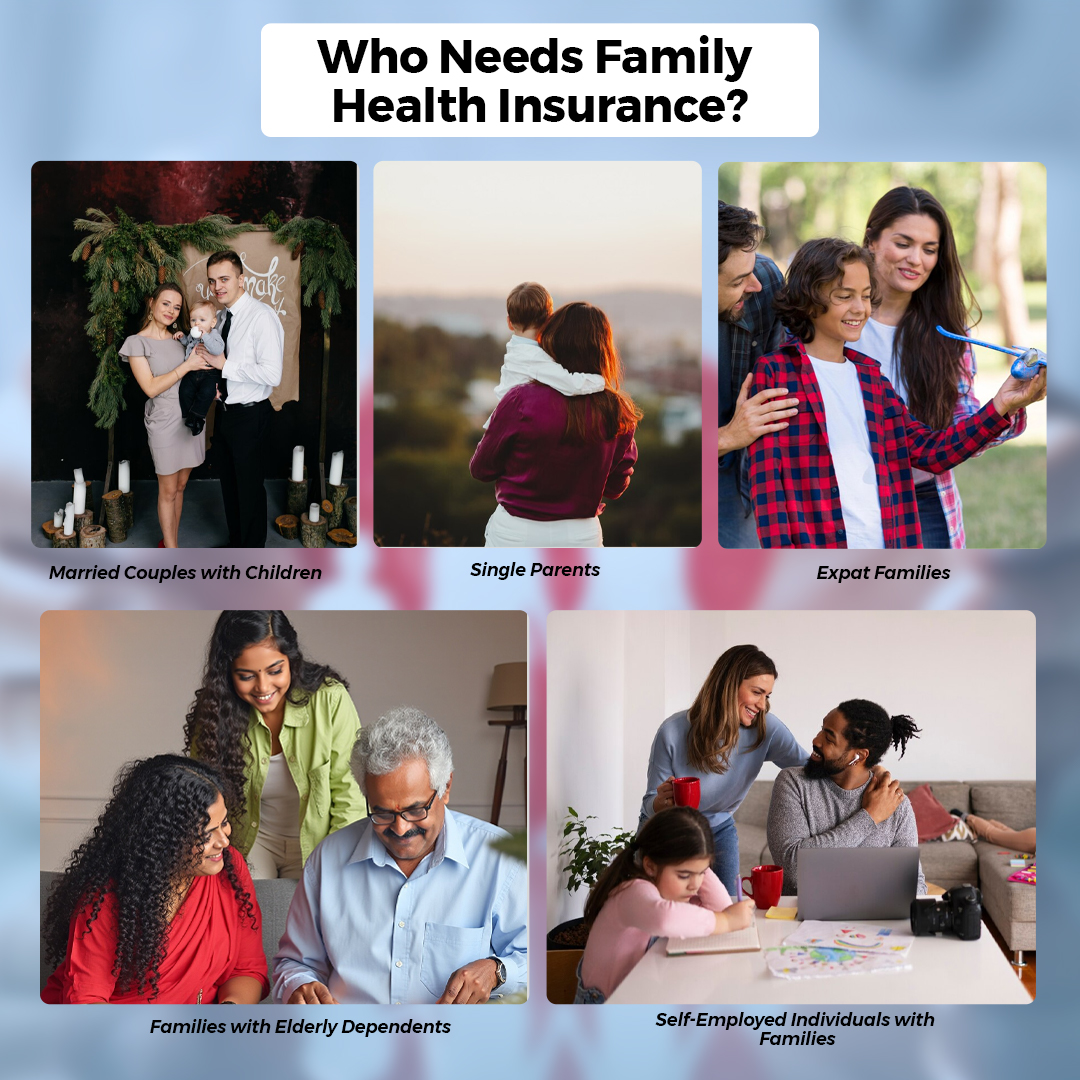

Who Needs Family Health Insurance?

Family health insurance isn’t just for one type of household — it’s a practical solution for many. Let’s see who can benefit the most:

- Married Couples with Children: Health insurance secures your family’s well-being by covering everyone — you, your spouse, and your children — under a single plan. This ensures that any unexpected medical bills don’t disrupt your financial plans.

- Single Parents: Raising children alone is already challenging. Family health insurance adds a safety net, protecting you and your kids from sudden healthcare expenses and giving you peace of mind.

- Expat Families: Living in a new country means adapting to a different healthcare system. Family health insurance provides financial protection, ensuring you can access quality care without the stress of unfamiliar medical costs.

- Families with Elderly Dependents: Managing age-related health issues for elderly parents or in-laws can be costly. Family plans help cover their medical needs, easing the financial strain of treatments or hospital stays.

- Self-Employed Individuals with Families: Without employer-provided benefits, self-employed individuals must secure their family’s health. A family insurance plan guarantees Coverage for you and your loved ones, protecting both health and finances.

Now that you know who can benefit from family health insurance, the next step is making sure you choose the right plan. Let’s explore how to buy the best family health insurance to ensure your loved ones get the protection they deserve.

How to Buy the Best Family Health Insurance

Choosing the right family health insurance doesn’t have to be complicated. Let’s break it down step by step so you can secure the best health insurance plan for your loved ones without any hassle.

- Visit the Portal Start by visiting a trusted insurance portal like Insura. It’s your one-stop platform to explore various family health insurance plans in the UAE. A reliable portal helps you compare multiple options, saving you both time and effort.

- Go Through the Benefits Don’t rush — carefully review the benefits each plan offers. Look for coverage details like hospital charges, maternity benefits, and emergency care. Make sure the plan aligns with your family’s healthcare needs and budget. This step helps you avoid surprise expenses later.

- Upload the Required Documents Once you’ve chosen the right plan, the next step is to upload the necessary documents. These usually include identification cards, proof of residence, and medical history. Having these ready speeds up the process and prevents unnecessary delays.

- Get Covered After submitting your documents, the insurer will process your application. Once approved, you’ll receive your policy details, and just like that — your family is covered! You can now rest easy knowing unexpected medical expenses won’t drain your savings.

By following these simple steps, you can secure comprehensive family health insurance without unnecessary stress.

Conclusion

We’ve explored how family health insurance helps you manage healthcare expenses, from covering hospital costs to offering preventive care and ensuring quality treatment. It’s more than just a safety net — it’s a smart way to secure your family’s health and financial future.

Ready to shield your family from unexpected medical costs?

Trust Insura.ae to find the best family health insurance plans in the UAE. Get a quote today and embrace a healthier, worry-free tomorrow!

Frequently Asked Question's

What are the benefits of a family plan?

A family health insurance plan offers cost-effective coverage for all family members under one policy, simplifying management and ensuring everyone gets equal protection.

What type of insurance would you consider the most important and why?

Health insurance is crucial as it safeguards your family from unexpected medical expenses, providing financial stability during emergencies.

How much is medical insurance for a family in UAE?

Family health insurance in the UAE typically starts from around AED 1,500 per person annually, but costs vary based on coverage, age, and health conditions.

What are the 4 advantages of family planning?

Family planning helps manage healthcare costs, ensures financial stability, supports maternal and child health, and allows better future planning.

Who needs health insurance the most?

Families with children, single parents, expat families, and those with elderly dependents need health insurance the most to protect against unforeseen medical expenses.