How To Make An Travel Insurance Claim Without The Stress

Table of Contents

ToggleYou don’t go to the deserts of the UAE just to see them—you go to be one with time itself, to listen closely to the sound of nothing, to taste the freedom of a road so open it feels like it never existed. But imagine this: when you’re ready to stand at the edge of the world, life’s uncertainties suddenly kick in. A lost passport, a sudden illness, or a canceled flight—it’s enough to bring even the most adventurous spirit to a halt.

In those moments, a travel insurance claim becomes more than a piece of paper; it’s the friend who catches you before you fall, giving you the freedom to breathe deeply, explore boldly, and experience life without the fear of “what if.” Yet, when it’s time to claim that lifeline, many UAE travelers find themselves tangled in a web of unfamiliar terms, missing documents, and stressful delays.

That’s where this blog steps in. Whether you’re facing a delayed flight, misplaced baggage, or a medical emergency abroad, this guide will help you navigate the travel insurance claims process like a pro. We’ll cover the different types of claims, explain when not to claim, and give you step-by-step instructions to ensure you get the support you need.

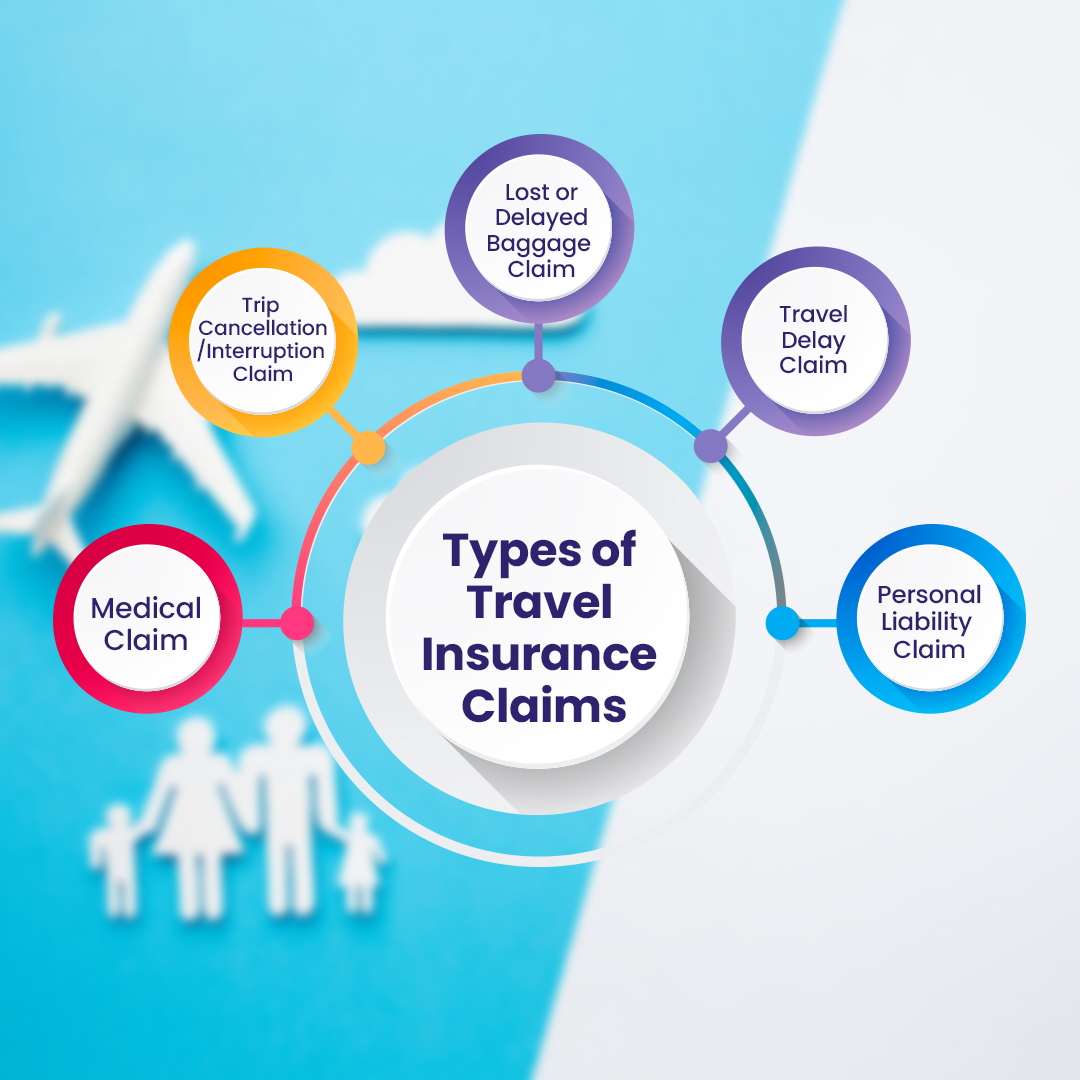

Types of Travel Insurance Claims

When life’s unpredictability meets the thrill of travel, having outbound travel insurance can make all the difference. Whether you face a medical emergency, misplaced baggage, or a trip delay, understanding the different types of claims will help you make the most of your policy. Let’s break down the most common claims, their coverage, and how they work with real-life examples.

Medical Claim

- What it covers: Unexpected medical expenses, including hospitalisation, treatment, and emergency evacuation abroad.

- Example: You slip while hiking in the Swiss Alps and fracture your leg. The medical costs for treatment and transport to a hospital can quickly add up. A medical claim ensures you’re reimbursed for these expenses.

- Why it’s important: Medical costs in foreign countries can be exorbitant, and this claim protects you from financial strain while ensuring you receive the necessary care.

Trip Cancellation/Interruption Claim

- What it covers: Non-refundable costs like flights, hotels, and pre-paid tours if your trip is cancelled or interrupted due to valid reasons (e.g., illness, natural disasters).

- Example: You have to cancel your dream trip to Italy because of a sudden illness. A trip cancellation claim reimburses your non-refundable flight and accommodation expenses.

- Why it’s important: Unexpected events shouldn’t mean losing the money you’ve invested in your travel plans. This claim helps you recover your costs and plan for another day.

Lost or Delayed Baggage Claim

- What it covers: Compensation for lost, damaged, or delayed luggage, and reimbursement for essential items you need in the meantime.

- Example: Your suitcase gets delayed en route to Bali, leaving you without clothes and toiletries. This claim helps cover the cost of purchasing temporary replacements.

- Why it’s important: Starting your trip without essentials can be stressful, but this claim ensures you’re financially supported until your baggage arrives.

Travel Delay Claim

- What it covers: Additional expenses incurred due to long delays, such as meals, accommodation, and transport.

- Example: Your flight from Dubai to Tokyo is delayed by 12 hours. A travel delay claim reimburses your hotel stay and food expenses during the wait.

- Why it’s important: Delays are frustrating, but this claim ensures you’re not left to shoulder the extra costs while waiting to continue your journey.

Personal Liability Claim

- What it covers: Costs for accidental damages or injuries caused to third parties during your trip.

- Example: You accidentally break an expensive lamp in a hotel room or collide with another cyclist on a rented bike. A personal liability claim covers the repair or medical expenses.

- Why it’s important: Accidents happen, and this claim protects you from bearing hefty out-of-pocket expenses or legal troubles.

By knowing how these insurance claims work, you can travel with peace of mind, knowing that your insurance has you covered. Next, we’ll walk you through the step-by-step process of claiming travel insurance, ensuring you’re prepared for any situation.

How to Claim Travel Insurance

Filing a travel insurance claim may seem like a daunting process, especially when you’re already dealing with the stress of unexpected travel hiccups. But with a clear understanding of each step, you can navigate this process effortlessly. Let’s break it down step by step to ensure you get the support you need without added hassle.

1. Contact Your Insurer

- What to do: As soon as an issue arises, inform your inbound travel insurance provider through their customer service helpline, email, or online portal.

- Why it matters: Prompt communication allows your insurer to guide you through the claim process and ensures that deadlines are met. Claims must be submitted within a certain amount of time according to many policies.

2. Gather Documents

To support your claim, you’ll need to provide specific documents based on the type of claim. Here’s a checklist:

- Claim form: Obtain and fill out the insurer’s official claim form.

- Proof of travel: Provide tickets, boarding passes, or booking confirmations.

- Medical records: If you’ve had a health emergency, include reports and hospital bills.

- Police report: Required for theft or accidents involving third parties.

- Receipts and invoices: Attach proof of expenses related to the claim.

- Photographs and witness statements: Useful for claims involving accidents or damage.

- Travel documents: Essential for claims related to delays or interruptions.

3. Read Your Policy

- What to do: Before submitting your insurance claim, review your policy documents to understand what’s covered, excluded, and required.

- Why it matters: Understanding your coverage prevents surprises and helps you submit a claim that aligns with your policy terms.

4. Submit Your Claim

- What to do: Send the completed claim form and all required documents to your insurer via email, their website, or in person.

- Why it matters: A complete submission ensures the process moves forward without unnecessary delays caused by missing paperwork.

5. Claim Assessment

- What happens: The insurer evaluates your insurance claim, verifying details, documents, and eligibility under your policy.

- Why it matters: The accuracy and authenticity of your documentation can significantly influence the approval process.

6. Decision and Settlement

- What happens: Once your insurance claim is assessed, the insurer will notify you of their decision. Approved claims proceed to settlement, while rejected claims will include an explanation.

- Why it matters: Knowing the reasons behind a rejection can help you avoid similar issues in the future.

7. Payment

- What happens: Approved claims are paid out via your preferred method, such as bank transfer, cheque, or direct deposit.

- Why it matters: Timely payment ensures you can move past the financial setback and continue enjoying your journey.

Filing a claim doesn’t have to be overwhelming. By following these steps, you’ll find the process straightforward and manageable. In the next section, we’ll discuss when filing a claim might not be the right choice, helping you make informed decisions and maximise your policy benefits.

When Not to Claim Travel Insurance

Travel insurance claim is designed to be your safety net, but there are instances when filing a claim might not be the best course of action. Knowing when not to claim can save you money in the long run and keep your policy benefits intact. Let’s explore these situations and how they can impact your future.

When the Cost is Lower Than the No-Claim Bonus

- The no-claim bonus often leads to lower premiums or enhanced benefits during policy renewals. Claiming for minor expenses can diminish these rewards. By assessing the cost-to-benefit ratio, you can make smarter financial decisions.

When a Third Party Can Pay the Cost

- Many travel disruptions are covered by airlines, event organisers, or other third parties. Using their compensation avoids using your policy unnecessarily, keeping your claims history clean and your future premiums unaffected.

Knowing when not to claim is as important as knowing how to claim. A well-thought-out approach ensures your policy serves you effectively while preserving its long-term value. . Up next, we’ll discuss why Insura’s travel insurance makes your claim experience even better, with quick settlements and unmatched support.

Save Your Traveling with Insura.ae Travel Insurance Plans

When it comes to travelling in the UAE best places, uncertainty can be the only certainty. From unexpected medical emergencies to last-minute cancellations, travel mishaps can turn your dream vacation into a nightmare. Selecting the appropriate travel insurance is so essential. Insura Travel Insurance stands out by offering unmatched support and hassle-free insurance claims, ensuring you focus on creating memories instead of worrying about the “what-ifs.” Let’s dive into the features that make Insura your perfect travel companion.

- International Toll-Free Phone and Fax Number: Accessing help should be simple, no matter where you are. Insura provides international toll-free numbers, making it easy for you to get assistance without extra costs.

- 24×7 Availability: Emergencies don’t follow office hours, and neither does Insura. Their round-the-clock assistance ensures you’re never alone during a crisis.

- Direct Communication: With Insura, there’s no maze of bureaucracy. Their clear and transparent process ensures you know what’s happening with your claim at every step.

- Quick Settlement:Insura understands that time is of the essence, especially when you’re already dealing with a setback. They prioritise faster claim approvals to help you recover quickly.

- Instant Work on Claims: Delays in claims processing can be frustrating. Insura takes immediate action on claims, ensuring minimal disruption to your plans.

Choosing Insura Travel Insurance means choosing peace of mind, trust, and reliability.

Conclusion

Navigating the travel insurance claim process can seem daunting, but understanding each step can save you time, stress, and money when the unexpected happens. From gathering the right documents to knowing when it’s best not to file a claim, staying informed ensures smoother and quicker reimbursements. It’s not just about protecting yourself during your travels; it’s about making smart choices that let you focus on enjoying the journey ahead.

Now that you know the essential steps, why leave your travel insurance to chance? Insura offers hassle-free, reliable coverage that provides peace of mind when you need it most. Ready to travel smarter? Explore Insura’s travel insurance options today and ensure your next trip is stress-free.

Are you prepared to handle the unexpected on your next adventure?

FAQ's

Does travel insurance cover stress?

Travel insurance generally does not cover stress unless it leads to a diagnosable medical condition requiring treatment.

Is it worth claiming for travel insurance?

Yes, it’s worth claiming if your loss exceeds the deductible and is covered under your policy terms.

How hard is it to claim travel insurance?

Claiming is straightforward if you provide proper documentation and meet the policy’s requirements.

Which circumstances are not covered in travel insurance?

Exclusions often include pre-existing conditions, reckless behaviour, and unapproved destinations.

Is anxiety covered by insurance?

Anxiety is typically excluded unless it’s part of a diagnosed mental health condition covered by the policy.