Top 9 Health Insurance Companies in UAE Provide Better Coverage

Table of Contents

ToggleChoosing the right health insurance plan from the right health insurance companies in UAE can feel like finding a needle in a haystack. With so many companies offering various benefits, coverage options, and costs, it’s easy to feel overwhelmed. Yet, having health insurance isn’t just about meeting a requirement—it’s about ensuring quality healthcare for you and your loved ones when you need it most. Unfortunately, many individuals struggle to find a provider that balances quality and affordability, especially with factors like waiting periods, network limitations, and claim processes to consider.

So, how do you find a reliable, budget-friendly health insurance provider in the UAE?

This blog is here to answer that question. We’ll walk you through the key factors to consider when choosing a health insurance plan, from understanding metal categories to weighing network types. Then, we’ll look at the top health insurance companies in the UAE, exploring what each has to offer so you can make an informed decision with confidence. Whether you’re after comprehensive coverage or a cost-effective plan, this guide will help you navigate your options with ease.

What You Should Look for in Health Insurance

Choosing health insurance in dubai UAE requires more than just a glance at premiums. To find a plan that truly works for you, it’s essential to dig deeper and evaluate how the plan fits your healthcare needs and budget. Do you compare insurance online or not? Here, we’ll break down the most important factors, from individual costs to provider network types, so you can make a confident choice.

From an Individual’s Point of View

- The 4 Metal Categories

Health insurance plans typically fall into four “metal” categories: Bronze, Silver, Gold, and Platinum. Each level represents a balance between monthly premium costs and out-of-pocket expenses. For example, Bronze plans often have lower premiums but higher deductibles, ideal for healthy individuals who rarely seek care. On the other hand, Platinum plans cover more upfront but cost more each month. Choosing the right category can prevent you from overpaying or, conversely, being underinsured when you need it most.

- Your Total Cost for Health Care

Beyond just monthly premiums, it’s essential to factor in deductibles, copayments, and out-of-pocket maximums. Many people focus solely on premiums, only to be surprised by high out-of-pocket costs later. Consider how often you visit doctors or need prescriptions—this will help you predict total costs. By knowing these numbers upfront, you avoid unexpected expenses and find a plan that truly fits your financial comfort zone.

- Plan and Network Type

Choosing between HMO, PPO, and EPO plans can impact your healthcare flexibility. For instance, HMO plans limit you to in-network providers, often requiring referrals for specialists, but they’re typically more affordable. PPOs offer flexibility with both in-network and out-of-network providers, though at a higher cost. EPOs are a middle ground with in-network coverage only but without referral requirements. Selecting the right network type ensures you’ll have access to the care you need without compromising on convenience or cost.

What to Look for While Choosing a Company

To make an informed choice, it’s crucial to assess the health insurance companies in UAE itself, not just the plan details. Here are key elements to consider when evaluating companies:

1. Waiting Period:

Some policies enforce a waiting period before benefits for pre-existing conditions kick in. Knowing the waiting time can prevent future disappointments and ensure that you’ll be covered when you truly need it.

2. Claim Process:

A smooth and transparent claim process just like Insura provides can make all the difference in a stressful health situation. Look for companies with a simple online claim submission and a reputation for quick settlements to avoid hassles down the line.

3. Maternity Cover:

If you’re planning to expand your family, maternity benefits can be crucial. Many insurers like Insura in the UAE offer maternity coverage that includes prenatal care, delivery, and postnatal care—helping you manage expenses and access quality care for both mother and child.

4. Pre & Post-Hospitalization Benefits:

Look for policies with pre and post-hospitalization coverage, which means your expenses are covered for treatments before and after your hospital stay. These benefits can ease your financial burden by covering costs associated with ongoing recovery and tests, ensuring comprehensive care beyond the hospital.

The top providers in the UAE offer these features and more, making it easier to find plans tailored to your needs.

Now that you know what to look for in a policy and provider, let’s dive into the different types of health insurance available in the UAE to understand which might suit you best.

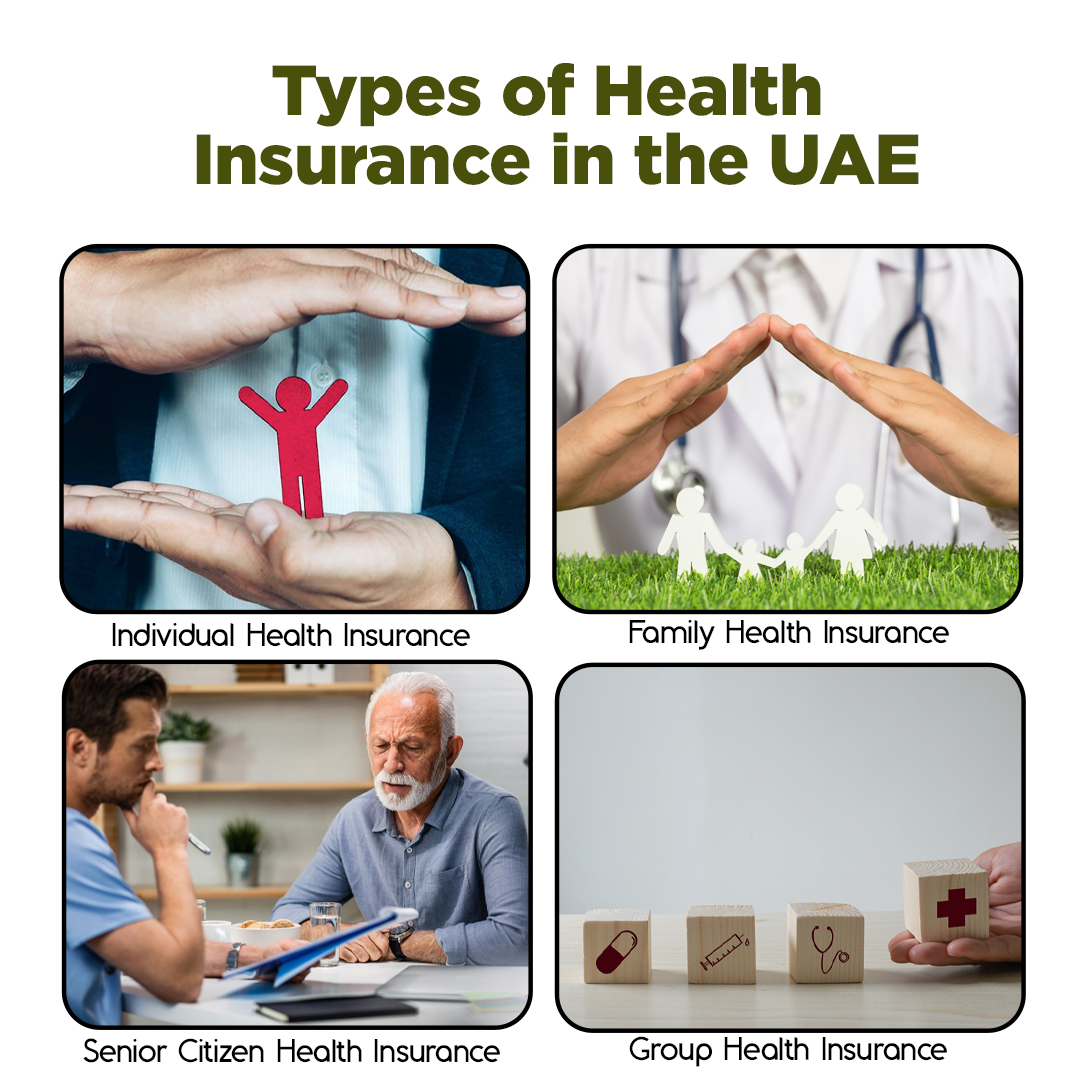

Types of Health Insurance in the UAE

Health insurance companies in UAE offer a variety of options, from individual to family and group plans. Each type provides specific benefits, so it’s essential to choose based on your life stage, family situation, or employment status. Here’s a quick guide to help you decide.

Individual Health Insurance

If you’re single or don’t have dependents, Insura Individual Health Insurance may be the ideal fit. This plan covers essential healthcare needs, offering flexibility in choosing a plan that fits your unique requirements and budget. For those focused on their healthcare without needing to factor in others, this is often the most cost-effective choice.

Family Health Insurance

For families, Insura family health insurance plans bundle coverage for multiple members under a single policy, providing better value and comprehensive coverage for the entire household. These plans make managing healthcare costs simpler by consolidating bills and coverage. If you’re seeking peace of mind for everyone in your family, this option is worth considering.

Senior Citizen Health Insurance

Insura Senior Citizen health insurance caters specifically to the healthcare needs of older adults. These plans often include benefits such as regular health check-ups, specialised treatments, and coverage for age-related conditions. Tailored to reduce out-of-pocket costs for seniors, these plans provide financial protection and focus on preventive care—a valuable choice for maintaining quality of life in later years.

Group Health Insurance

Insura Group Health Insurance is a popular benefit offered by employers, providing coverage to employees and, in some cases, their dependents. These plans are generally more affordable since premiums are partially covered by employers, making them attractive for employees. Group health plans can provide employees with essential healthcare without added expenses, promoting well-being at a lower cost.

With these options, finding the right type of health insurance in the UAE becomes simpler. Next, let’s explore the top health insurance companies in the UAE, so you can choose a provider that offers the best value and services tailored to your needs.

Top Health Insurance Companies in UAE

In the UAE, choosing the right health insurance provider in UAE can make all the difference in managing healthcare costs and ensuring quality service. Here’s a quick look at some of the most reputable health insurance companies in the UAE and what sets each apart. These companies offer various plans to meet different needs, making it easier to find coverage that aligns with your lifestyle and budget.

Company | Key Highlights |

RAS Insurance | Offers a broad range of plans with affordable premiums and strong customer service. Known for quick claim settlements and transparent policies. |

Orient Insurance | Specialises in comprehensive health coverage with options for families and individuals. Notable for its extensive hospital network and flexible plans. |

Tokio Marine Insurance Group | Provides both basic and premium health coverage, focusing on global medical access and robust policy options. Ideal for frequent travellers. |

Adamjee Insurance | Known for customisable plans and competitive pricing. Includes special packages for families and seniors, making it a versatile choice for varied needs. |

Oriental Insurance | Offers budget-friendly health plans with a strong emphasis on covering essential medical services. Suitable for those seeking reliable coverage at lower costs. |

Gulf Insurance Group | Renowned for its wide network and excellent maternity benefits. Caters especially to families, offering seamless claim support and preventative care options. |

Sukoon Insurance | Provides unique coverage options, including wellness programs and access to specialist treatments. Focused on well-rounded healthcare support. |

The New India Assurance Co. Ltd. | An established provider known for affordable family and senior citizen plans. Offers a vast network of clinics and hospitals for easy access to care. |

Alwathba National Insurance | Provides tailored health insurance for various age groups and needs, including family and individual plans. Focused on competitive premiums and good coverage. |

Final Words

Choosing the right health insurance provider is a crucial step toward safeguarding your health and financial well-being. With so many options available, it’s essential to assess your unique needs, whether it’s individual coverage, family plans, or tailored benefits for seniors. Each company on this list offers something different, so take your time to explore and find the perfect fit.

For expert guidance and a seamless selection process, visit Insura, where we’ll help you secure the best health insurance plan in the UAE. Your health deserves nothing less!

FAQ

The best medical insurance in the UAE often depends on individual needs, but Insura offers a variety of comprehensive plans that cater to different lifestyles and budgets.

The largest health insurance company in the UAE is Abu Dhabi Health Services Company (SEHA), which provides a wide range of healthcare services and insurance options.

While opinions may vary, Insura is known for its competitive plans and exceptional customer service, making it a top choice for many seeking quality health insurance.

The UAE’s healthcare system is highly ranked globally, often placing within the top 30, thanks to its advanced medical facilities and quality care.

The 2nd largest insurance company in the UAE is Abu Dhabi National Insurance Company (ADNIC), known for its extensive range of insurance products, including health insurance.